FAQ

1. What is this case really about?

This is a $15 billion whistleblower and arbitration case against one of the largest pharmaceutical companies in the world, Sanofi. The claim is that Sanofi has been hiding thousands of W-2 workers under dissolved, fake, or shell companies in order to avoid paying proper wages, taxes, and benefits, and to avoid legal accountability. This includes vendors operating inside Costco and other major retailers.

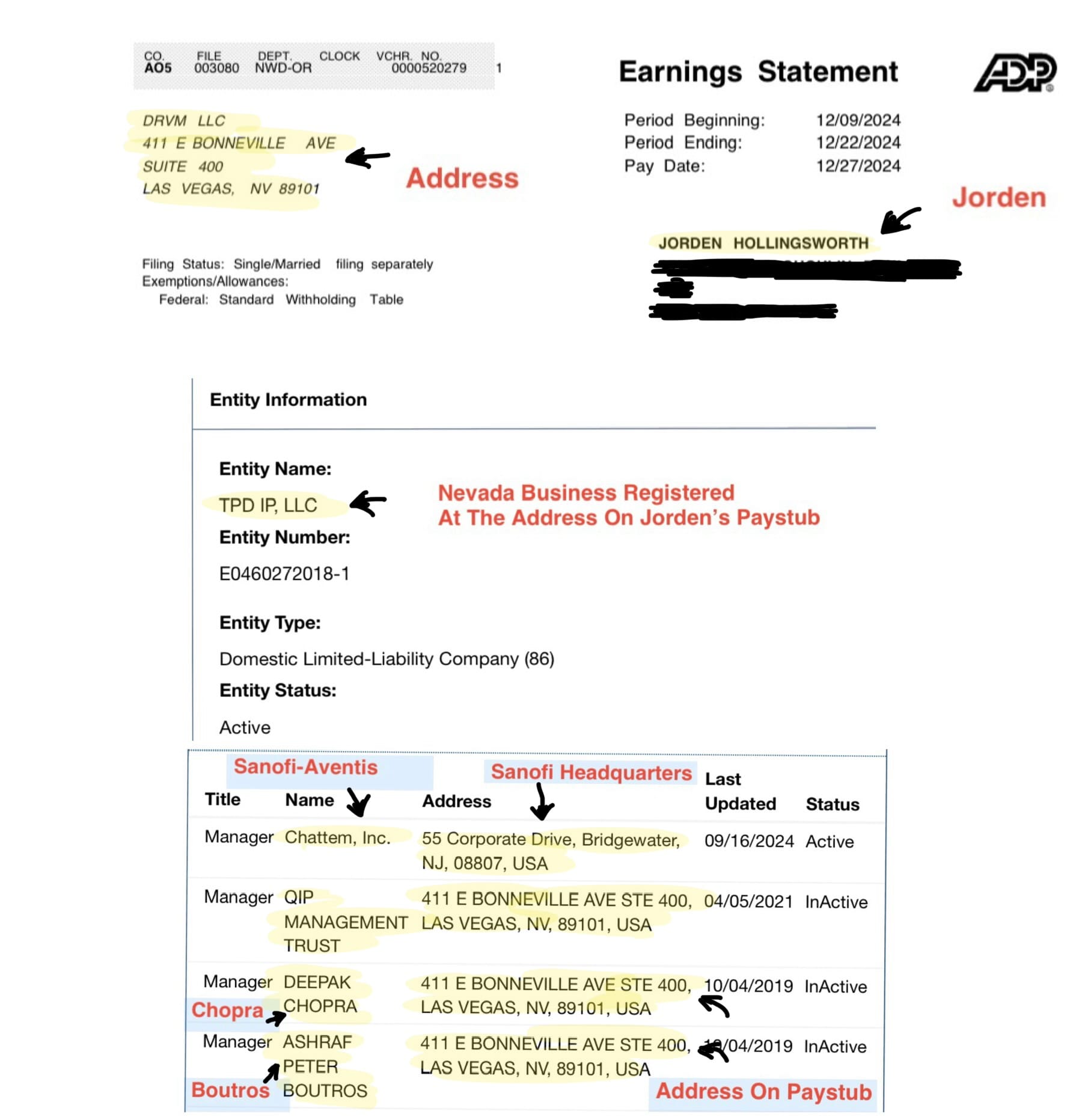

2. How is Sanofi connected if the paystub says another company?

Sanofi used layered entities to distance itself from direct responsibility, but the people giving orders, collecting data, controlling sales materials, and managing the workers are tied back to Sanofi-owned or -controlled companies. Exhibits show Sanofi has ownership links, shared addresses, and overlapping management across these supposedly independent vendors.

3. Isn’t this just a subcontracting structure? What makes it illegal?

Subcontracting is legal, but not when used to commit fraud. If you:

• Misclassify W-2 employees under fake or dissolved entities

• Hide the real employer from regulators and workers

• Fail to report that workforce to shareholders

• Use shell companies to avoid wage laws and retaliation claims

That’s not subcontracting. That’s illegal. This case involves wage fraud, tax evasion, obstruction, and potentially racketeering (RICO).

4. Why $15 billion? That seems huge.

It is, and it’s appropriate given the scale.

Sanofi is worth over $120 billion, with $50 billion in annual revenue. Even a 10% valuation impact from fraud tied to U.S. operations would be $12 billion. This case affects thousands of workers, spans multiple states, and involves deception across corporate filings, wage systems, tax documentation, and public representations.

Also, if RICO is proven, the law allows treble damages, meaning $5 billion in fraud becomes $15 billion in liability.

5. Why hasn’t the government stepped in?

They have. IRS claim numbers have already been issued, confirming this case is formally under review by federal agencies.

However, whistleblower investigations often take years, and many are quietly buried. That’s why I made the decision to go public, document the entire case, and file in federal court while arbitration was being obstructed.

6. Why didn’t this come out sooner?

Because the structure was designed to stay hidden. Vendors inside places like Costco appeared independent, but the connections to Sanofi were buried under layers of filings, dissolved companies, and obscure corporate control.

The fraud was only uncovered when I wasn’t paid on time, investigated the paystub address, and began unraveling the shell network behind it.

7. Is this just about one paycheck or late wages?

Absolutely not. That’s how it started, but what was uncovered is systemic fraud:

• Thousands of workers across state lines

• Hidden under inactive or shell companies

• Controlled by a multibillion-dollar pharmaceutical giant

• Never told who their real employer was

• No benefits. No protections. No accountability.

8. Isn’t this a conspiracy theory?

No. This is fully documented through:

• Over 100 exhibits

• Public business filings

• Emails, paystubs, and corporate registrations

• IRS confirmations

• JAMS arbitration filings

• A federal case filed under the FAA

This isn’t a theory, it’s a documented fraud structure that existed in plain sight, protected by complex legal layering and public ignorance.

9. What is JAMS and why does it matter here?

JAMS is a private arbitration provider used by many corporations to resolve disputes outside of court. In this case, JAMS was used to delay justice, protect elite respondents, and assign unqualified arbitrators.

Eventually, I had to file a federal petition to remove the arbitration bottleneck and force real accountability.

10. Who is the person bringing the case?

A former worker under DRVM LLC, paid under a dissolved entity, who discovered the fraud while trying to get paid. They are representing themselves and using AI tools to build the case, file federal documents, and expose one of the most elaborate wage fraud networks ever uncovered.

11. What stage is the case in now?

• Federal judge has ordered US Marshals to serve all 9 respondents

• Respondents are now appearing under court order

• Discovery has not yet begun, which means more layers are coming

• IRS claim is active

• Media coverage is being blocked, but public records are growing

12. What happens if this case wins?

If the claimant wins:

• A precedent will be set for wage and shell company fraud

• Sanofi could face billions in damages

• The entire shell structure could collapse

• Other companies using similar setups could be exposed or prosecuted

• Workers may finally gain transparency, benefits, and protections

• One person using truth + AI will have reshaped the legal landscape

14. How did one person uncover this? Isn’t that impossible?

It happened because one person got curious after not being paid. Instead of moving on, they looked into the company listed on their paystub, and found it was dissolved. From there, they uncovered a network of shell companies, fraudulent filings, and connections leading back to Sanofi. They used AI tools (like ChatGPT and public databases) to investigate, cross-reference, and file one of the most sophisticated whistleblower cases in modern history.

15. What is RICO and how does it apply here?

RICO (Racketeer Influenced and Corrupt Organizations Act) is a federal law used to target criminal enterprises that commit ongoing fraud across multiple people and entities. If proven, RICO allows for triple damages, making a $5 billion case worth $15 billion. RICO doesn’t just apply to mobsters, it applies to any coordinated, concealed system of fraud. The use of multiple shell companies, cross-state operations, and intentional concealment could qualify under RICO standards.

16. Why does this matter to the average worker?

Because this same strategy is happening everywhere. If a company can hide its workforce under fake or shell entities:

• You lose your legal rights as an employee

• You can’t sue the real company if something goes wrong

• You don’t get proper benefits, protections, or wages

• Your labor is used to build up a brand that disowns you

This case matters because it shows how even one worker can expose the entire system.

17. What does this have to do with Costco?

Sanofi’s vendors operated inside Costco locations, selling products like Qunol CoQ10, vitamins, and other supplements. But the people running those demo booths were hired under companies like DRVM LLC — a dissolved company — with no public connection to Sanofi. Costco appeared clean, but behind the scenes, Sanofi controlled the pipeline. That’s how they scaled fraud while hiding it under retail brands that the public trusts.

18. Isn’t arbitration supposed to be private? Why is this public?

Arbitration can be private, but that doesn’t mean the parties are silenced forever. In this case, the claimant is:

• Representing themselves (pro se)

• Requesting public disclosure of filings

• Exposing alleged procedural corruption

• Filing in federal court under 9 U.S.C. § 5

• Submitting whistleblower evidence to the IRS and federal agencies

Privacy in arbitration does not override fraud or public interest.

19. Why are so many social media posts about this being removed?

The claimant has been banned from Reddit, X, Medium, had TikToks throttled, and posts removed across platforms. Even content with proof and evidence is labeled “misinformation” or “spam.” The truth is, exposing powerful companies scares systems. Moderation often favors those with lawyers, not whistleblowers. That’s why this site exists, to preserve and share the truth directly with the public.

20. How has Sanofi responded to the allegations?

They haven’t, not publicly. In arbitration, they:

• Hid for months

• Withdrew law firms mid-case

• Rejected AI-qualified arbitrators

• Attempted to avoid discovery

• And now face U.S. Marshals being ordered to serve them

If the case was baseless, they could have responded easily. Instead, they’ve fought to avoid process, which says everything.

21. What role does AI play in this case?

AI is a key part of this story. The claimant used AI to:

• Investigate shell companies

• Draft filings and motions

• Study legal precedent

• Build a 100+ exhibit record

• Expose gaps in corporate filings

• Reach the public across platforms

This isn’t just a legal case, it’s a historic use of AI to expose corporate fraud, shift power dynamics, and show that truth + tech can take on billion-dollar systems.

23. How does this compare to other major corporate fraud cases?

This case echoes elements of Enron, Theranos, and the Panama Papers:

• Enron used shell companies to hide liabilities and inflate profits.

• Theranos made bold claims that fell apart under scrutiny once the truth emerged.

• The Panama Papers exposed global use of offshore shell companies to evade taxes and hide assets.

The difference here? It’s happening inside the U.S. using domestic shell companies, retail environments like Costco, and publicly traded pharma products, all hidden behind layers of ownership and legal structuring.

24. Why are you doing this without an attorney?

Most attorneys are trained to bury this case, even after seeing clear evidence. Many were afraid of the scale, the corporate power, or the complexity. Some even tried to discourage the claimant from continuing.

Instead of giving up, the claimant turned to AI, self-study, and public support. This case is being built by truth, intelligence, and persistence — not money or institutional backing.

25. Doesn’t this sound like a conspiracy theory?

It might, until you look at the documents.

This isn’t a story made up in someone’s head. It’s backed by public records, corporate filings, IRS whistleblower submissions, JAMS arbitration history, and now a federal court case.

The only reason it sounds like a conspiracy is because people aren’t used to seeing one person expose this level of corporate concealment. But if you review the exhibits, it’s not a theory, it’s documented reality.

26. What makes this case different from a normal employment dispute?

This isn’t about one job or paycheck, it’s about thousands of workers being routed through dissolved or fake companies, with no access to HR, no benefits, no ability to sue, and no disclosure of the real employer: Sanofi-Aventis US.

This is not a miscommunication. It’s a systemic concealment strategy, and that’s what makes it so legally dangerous for the companies involved.

27. Why does this matter to shareholders?

Because shareholders are being misled about liability. If Sanofi is employing thousands of U.S. workers, but hiding those employees under shell companies, then:

• Labor costs are being hidden from investors

• Risk is being offloaded to “independent” vendors

• Fraudulent statements may be filed with the SEC

• Whistleblower fines and RICO damages could affect the stock price

That’s why this isn’t just about labor, it’s about corporate disclosure fraud too.

28. How did this get into federal court?

After months of obstruction in arbitration (JAMS), the claimant filed a petition under 9 U.S.C. § 5 to compel arbitrator appointment and expose manipulation of the arbitration process.

The federal court granted in forma pauperis status, and ordered U.S. Marshals to serve all nine respondents across multiple states. That alone is historic, and it’s only the beginning.

29. What’s the connection to Sanofi? They say it’s unrelated.

Sanofi owns the brands being sold, the trademarked products, and multiple companies operating out of the same address listed on paystubs. Those companies include Quten Research Institute, Chattem Inc., and others.

These entities share officers, addresses, and IP ownership, and are structured to conceal Sanofi’s liability. The trail leads directly to them, and they know it.

30. What is the address at the center of this fraud?

Most of the paystubs and corporate filings trace back to:

411 E. Bonneville Ave #400, Las Vegas, NV 89101

This address has been used by:

• DRVM LLC (the dissolved employer)

• AMJ Services (another shell)

• Quten Research Institute

• Sanofi’s legal and structural arms

This isn’t just a “mailbox” it’s a layered concealment hub. The people running these companies are registered as officers of multiple entities, which share Sanofi-owned product pipelines.

31. What is the IRS doing with this case?

The IRS has assigned formal claim numbers, confirming this is an active whistleblower submission. They are reviewing allegations of:

• Payroll tax fraud

• Misclassification

• Corporate concealment

• W-2 issuance under dissolved entities

This isn’t speculation, it’s already under federal scrutiny.

32. What happens next?

Several things:

• All nine parties are being served by U.S. Marshals

• Federal proceedings are now active

• More motions and exhibits are being filed weekly

• Discovery will expose deeper layers

• The public record is growing fast

This case is just beginning, and it’s growing by the day.

33. Isn’t DRVM a valid company now? Why does it matter that it was dissolved?

DRVM LLC was dissolved in Oregon, and remained dissolved throughout the time the claimant was employed, as well as during the initial stages of arbitration. Only after six months of arbitration filings and IRS whistleblower activity, DRVM was suddenly reactivated in Oregon.

This reactivation was not organic. It took place after legal filings had already exposed the shell structure, and appears timed to give the illusion that DRVM was always active, a tactic used to shield upstream entities like Sanofi and Chattem from accountability. The timeline alone raises red flags about intent to conceal and retroactively legitimize a dissolved shell.

34. What’s the truth behind the $6,130 deposit?

Roughly seven months after the claimant’s last day of work, and six months into arbitration, DRVM LLC made a secret $6,130 deposit directly to the claimant’s checking account.

This was not a paycheck. It was never disclosed publicly or filed through the proper JAMS channels. The deposit came after months of non-payment, obstruction, and legal concealment, and appeared strategically timed to trigger a mootness argument, as if they had “made things right” after the fact without any discussion.

But instead of resolving anything, the deposit confirmed what’s now been submitted to the IRS and the federal court: DRVM (and the parties hiding behind it) attempted to paper over a fraud structure with a one-time, off-record payout after they’d been caught.

35. How does this tie to IRS whistleblower filings?

The IRS has already assigned 3 official claim numbers for Sanofi, Quten Research Institute, Chattem, and others. These filings involve wage fraud, shell company concealment, and tax violations.

Reactivating DRVM mid-arbitration and attempting to hide behind it directly interferes with the IRS’s investigation. The timeline shows a reactive cover-up, not a legitimate employer operation.

36. Who is DRVM, and how are all nine entities hiding behind it?

DRVM LLC is a dissolved shell entity that issued paystubs and W-2s. However, multiple larger entities, including Sanofi, Quten, AMJ Services, and others — are trying to position DRVM as the “only” party involved.

They’re using DRVM as a legal firewall to prevent the claimant from reaching the true parent companies. Even though the work was performed on behalf of Sanofi-owned products in retail settings like Costco, those companies are pretending to be uninvolved.

37. Why were all nine entities named in the arbitration?

Because they are all connected through structure, ownership, or concealment tactics:

• AMJ Services ran payroll for DRVM

• Quten Research Institute owns trademarks and IP

• Chattem Inc. is a Sanofi subsidiary producing the products

• Sanofi-Aventis U.S. is the parent

• Maged and Ashraf Boutros are officers tied to multiple shells

They cannot claim separation while sharing addresses, officers, trademarks, and oversight.

38. What was the role of JAMS in allowing this concealment?

JAMS allowed months of procedural delay, failed to enforce proper party representation rules, and initially permitted arbitration to move forward with only DRVM listed, despite knowing that:

• DRVM was dissolved

• No lawyer had authority to represent all parties

• Shell structures were in dispute

Only after public pressure and whistleblower filings did JAMS begin changing course, and even then, they tried to assign arbitrators with no tech, fraud, or whistleblower experience.

39. What happened with the U.S. Marshals?

A federal judge reviewed the record and ordered U.S. Marshals to serve all nine respondents across multiple states. This includes Sanofi, AMJ, DRVM, Quten, and individual officers.

This is a rare and serious step, especially after months of concealment in arbitration. It signals that a federal court recognizes the seriousness of the allegations and the failure of prior private processes.

40. Are these companies trying to argue the case is moot now?

Yes, by reactivating DRVM, funding the deposit secretly, and pretending arbitration was proceeding, the respondents may attempt to argue that:

• The arbitration process was already in motion

• The issues have already been addressed

• The claimant delayed or abandoned the process

But the record shows otherwise: delays were caused by misrepresentation, concealment, and procedural manipulation, not claimant inaction.

41. Why did they pick DRVM as the firewall?

Because DRVM was a small, obscure company, easy to control, dissolve, and resurrect. By isolating all legal activity under DRVM, the real entities hoped to:

• Shield themselves from liability

• Avoid court exposure

• Keep arbitration private and low-risk

But now, with public filings, exhibits, and IRS involvement — that firewall is collapsing.

42. What happens next?

The case is moving in two directions:

• Federal court proceedings will establish jurisdiction and transparency

• Arbitration filings and motions will continue, now under public pressure

More exhibits, discovery motions, and whistleblower confirmations will emerge. This is only the beginning, and it’s now documented in both federal and whistleblower frameworks.