Scale of $15 Billion

How Is This $15 Billion Case Even Real?

Let’s start with the obvious:

Yes, it sounds extreme that one person is alleging over $15 billion in fraud.

But when you actually step back and look at the scale, it becomes not only believable, but inevitable.

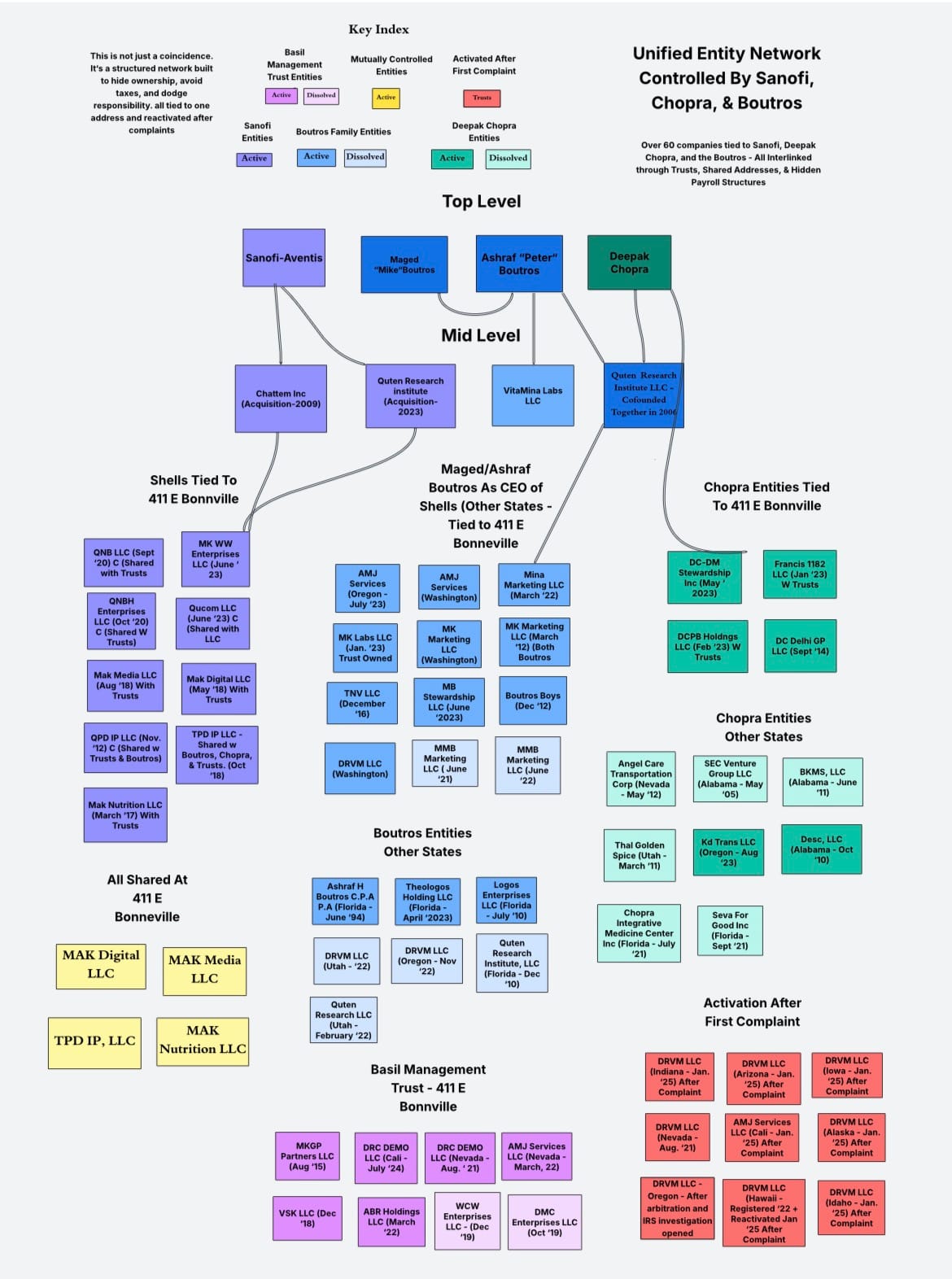

This is not a local company or a neighborhood dispute. This is a case against Sanofi, a top six pharmaceutical company in the world, valued at over $120 billion, generating over $50 billion per year in revenue, with the majority of its revenue now flowing from the U.S. market.

This is a Fortune 500 giant, and they didn’t get that big without engineering complex structures to insulate themselves from accountability.

This Isn’t About One Paycheck. It’s About a Rigged System.

This case isn’t about one missing paycheck or one bad manager.

This is about a systematic, engineered fraud, created by some of the most sophisticated corporate lawyers in the world — designed to:

• Hide parent-company control behind shell companies

• Disguise thousands of workers as if they weren’t employed by Sanofi at all

• Avoid legal liability, taxes, and benefit obligations

• Obstruct whistleblowers, delay lawsuits, and bury responsibility

It was designed to be invisible. But I found it. And I’m proving it publicly.

Why $15 Billion? Look at the Numbers.

If you take just 10% of Sanofi’s valuation, a company built on questionable structures and concealed labor — that’s already $12 billion. And everything I’ve uncovered points to even more than that.

This isn’t just my opinion, it’s now been reviewed by:

• Federal courts

• The IRS Whistleblower Office

• Labor boards

• And now, U.S. Marshals are serving all nine respondents across multiple states.

And this is still before discovery.

Discovery Hasn’t Even Started Yet

Here’s what’s crucial:

We’re not even in discovery. Not one subpoena has been issued. Not one deposition taken.

Everything I’ve shown the world is surface-level.

But we’re now entering the phase where:

• Internal emails will be demanded

• HR records and tax documents will be exposed

• Control structures will be forced into the open

• Hidden agreements and private deals will come to light

If the surface already shows this much fraud, just imagine what’s underneath.

This Is RICO-Level Conduct

Let’s make it simple:

This is illegal. And it falls under RICO — the Racketeer Influenced and Corrupt Organizations Act.

This means:

• Treble damages — triple the financial harm

• System-wide civil liability

• Criminal exposure for orchestrators

We’re talking about a structure that denies benefits, conceals ownership, lies to the government, and robs employees, all under the protection of fake or dissolved companies. If that’s not RICO, nothing is.

It’s Bigger Than the $14.6B DOJ Medicare Case

Recently, the DOJ announced a $14.6 billion Medicare fraud case involving over 300 doctors and providers who submitted false claims.

But that case was limited to Medicare.

This one affects:

• Employees who were stripped of benefits

• Regulators who were misled

• Consumers who bought products under a false corporate identity

• Shareholders who invested in a company hiding risk

• And taxpayers who unknowingly footed the bill for a corporate shell game

This is fraud on all fronts.

Sanofi’s History Speaks for Itself

This isn’t Sanofi’s first scandal.

They’ve been connected to:

• Shell-based bribery (see: Elf Aquitaine)

• Global corruption probes

• Concealed payments and offshore accounting

• A deep history of reputation management and legal insulation

They’ve learned to build layers. This time, I pulled them back.

“You’re Just One Person” — Exactly.

The biggest lie society tells us is that only people with titles are allowed to tell the truth.

But titles don’t uncover fraud. Persistence does.

And the truth doesn’t care whether it’s spoken by a CEO or a Costco vendor.

I’ve laid it all out for you. In court filings. On this site. In the exhibits.

This is real. It’s happening. And it’s already changing everything.

This Case Wasn’t Discovered by the Government. It Was Found by One Person With AI.

The DOJ didn’t break this story. The IRS didn’t. No federal agency did.

I did.

Using public records. Exhibits. Payroll documents. Corporate filings.

With the help of AI, I mapped out a structure that was never meant to be seen.

And now, with the case in federal court, the public has access to everything.

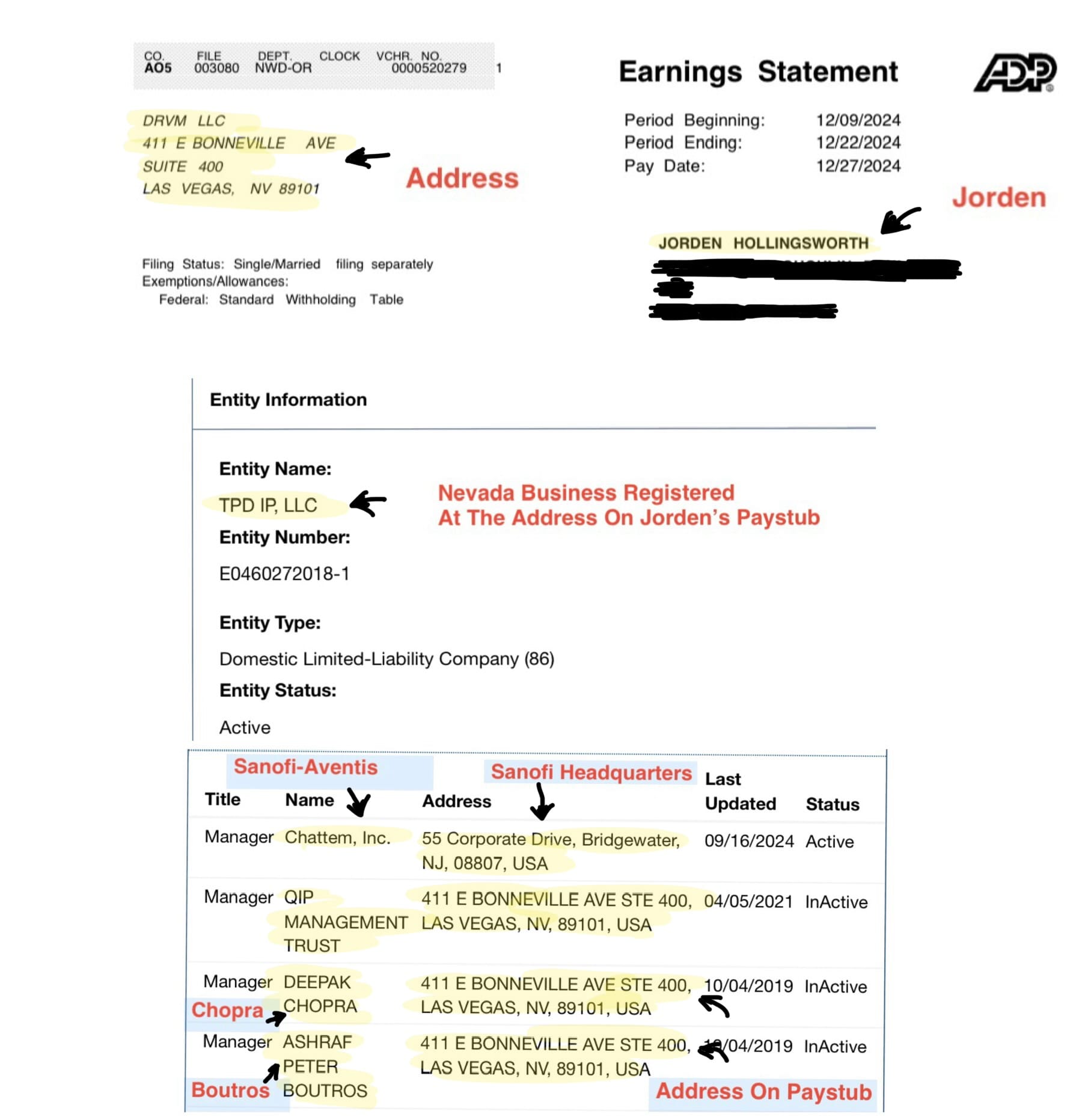

The Shell Game Behind the Paystub: How Sanofi Built a Hidden Workforce

Most people glance at a paystub and assume the company listed is their true employer.

But what if that company:

• Doesn’t legally exist?

• Has no offices, no HR department, and no real operations?

• Isn’t listed anywhere on the parent company’s public filings?

That’s exactly what’s happening here. And the evidence starts with the address on the paystub.

This Address Is Not Just a Registered Agent

Some critics might assume, “Oh, that’s just a registered agent, every company uses one.”

Let’s be clear: That’s not what this is.

Registered agents are third parties, typically law firms or compliance services — who receive legal paperwork.

But in this case, we’re not just looking at a mail drop. We’re looking at the exact address on the paystubs, which is tied to:

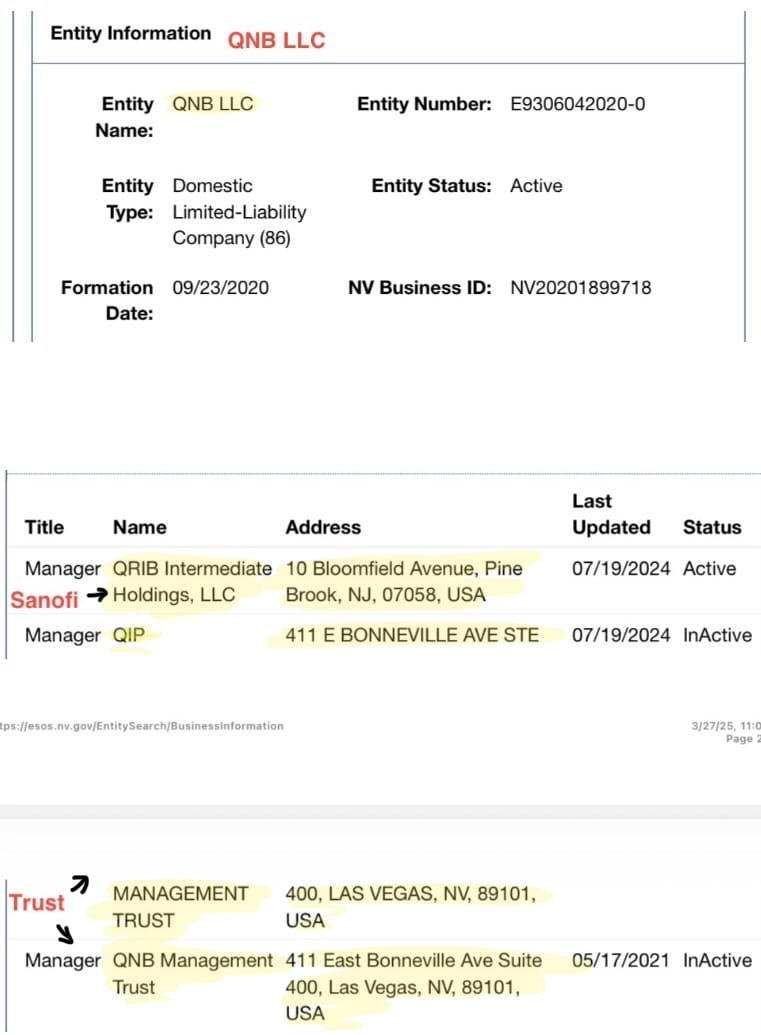

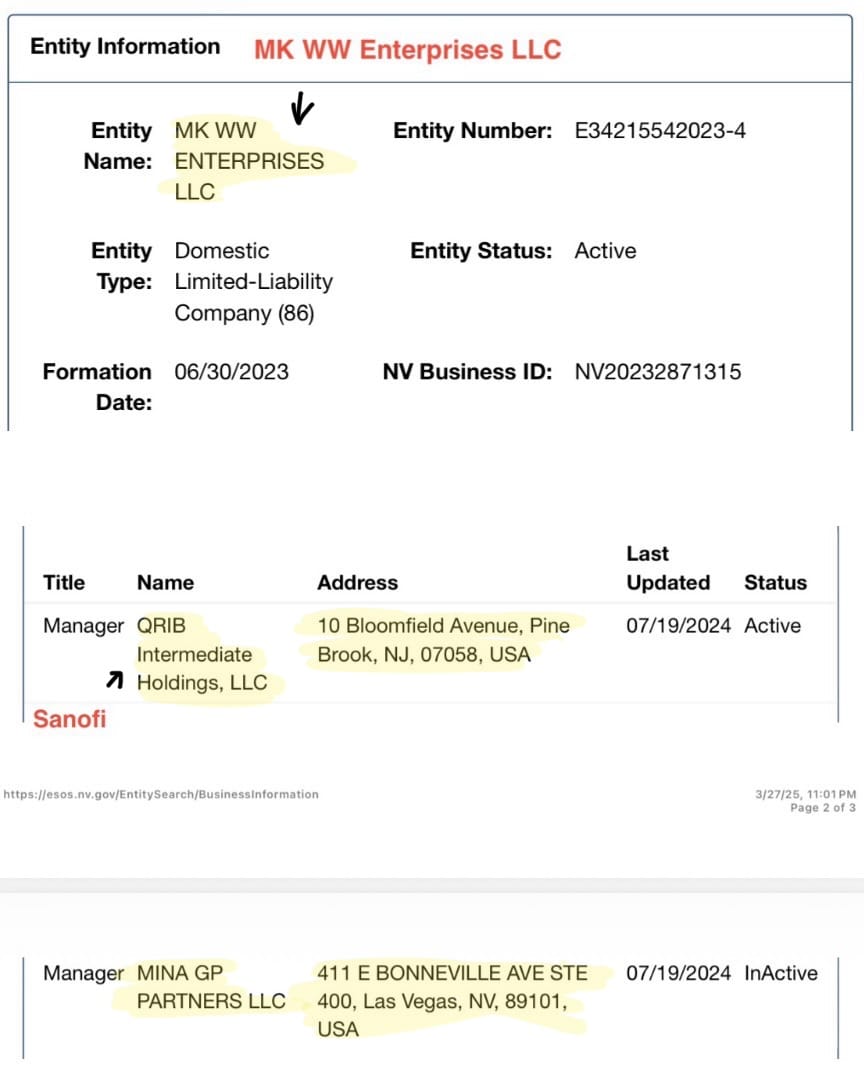

• Multiple shell entities owned or managed by Sanofi-connected individuals

• Shared member and manager names across multiple filings

• A workforce operating under those entities with no clear legal employer

This is not a coincidence. It’s a carefully engineered structure designed to hide control, evade accountability, and avoid employee protections.

Sanofi’s Entities at the Address: More Than a Coincidence

Let’s break it down:

• Sanofi, directly or indirectly, owns or manages several entities at the exact address on the paystub

• These entities often share overlapping managers, members, and signatories

• The address is not a standalone operation, it’s a hub for layered ownership

• Workers were onboarded, paid, and directed through entities tied to that same location

This isn’t one rogue company acting alone, this is a corporate structure operating in Sanofi’s shadow.

And yet, there’s no public disclosure in Sanofi’s SEC filings or investor communications identifying these entities or the thousands of employees attached to them. That is a material omission. If you’re a shareholder, employee, regulator, or reporter, you should be asking why.

Why It Matters: Hidden Workforce, No Rights

Let’s imagine you’re one of the thousands of workers paid under this shell company:

• You get a W-2 under a company that no longer exists or has no operational website

• You’re told to speak to HR, but no phone number is given

• You complain about missing pay or benefits, and your emails go to a generic inbox or disappear

• You try to sue, but the entity you worked for is dissolved, and Sanofi says they’re not involved

That’s not just wrong. That’s illegal.

Under federal labor and tax law, a parent company cannot hide its workforce under fake or dissolved entities while still controlling:

• Payroll

• Products sold

• Uniforms and branding

• Sales scripts

• Worksite locations (like Costco)

• Supervisors and managers

If you have control, you are the employer. Period.

This Is Fraud. Not a Loophole.

Let’s be blunt. This is not some clever tax strategy.

This is not “just the way big companies operate.”

This is:

• Wage fraud

• Tax evasion

• Benefit denial

• Whistleblower obstruction

• Shareholder deception

And most importantly, this is a case of racketeering, where multiple entities work together to execute and conceal the same scheme. That falls squarely under RICO.

What Makes This Illegal

A $15 Billion Fraud Hidden in Plain Sight

f