Intent Is Already Proven. Reactivations, Deposits, and a Trail of Conscious Moves

This Isn’t Just Fraud. It’s Intentional.

When you’re dealing with a billion-dollar corporate fraud, one of the hardest things to prove is intent. Anyone can say something was a clerical error, a misunderstanding, a paperwork issue. But when every action, across multiple states, multiple entities, and multiple months, lines up perfectly after the legal risk is made clear, what you’re looking at is no longer incompetence. It’s intent.

And the evidence is everywhere.

Nationwide Activations After My First Complaint

I told them I was pursuing legal relief. Then the activations started.

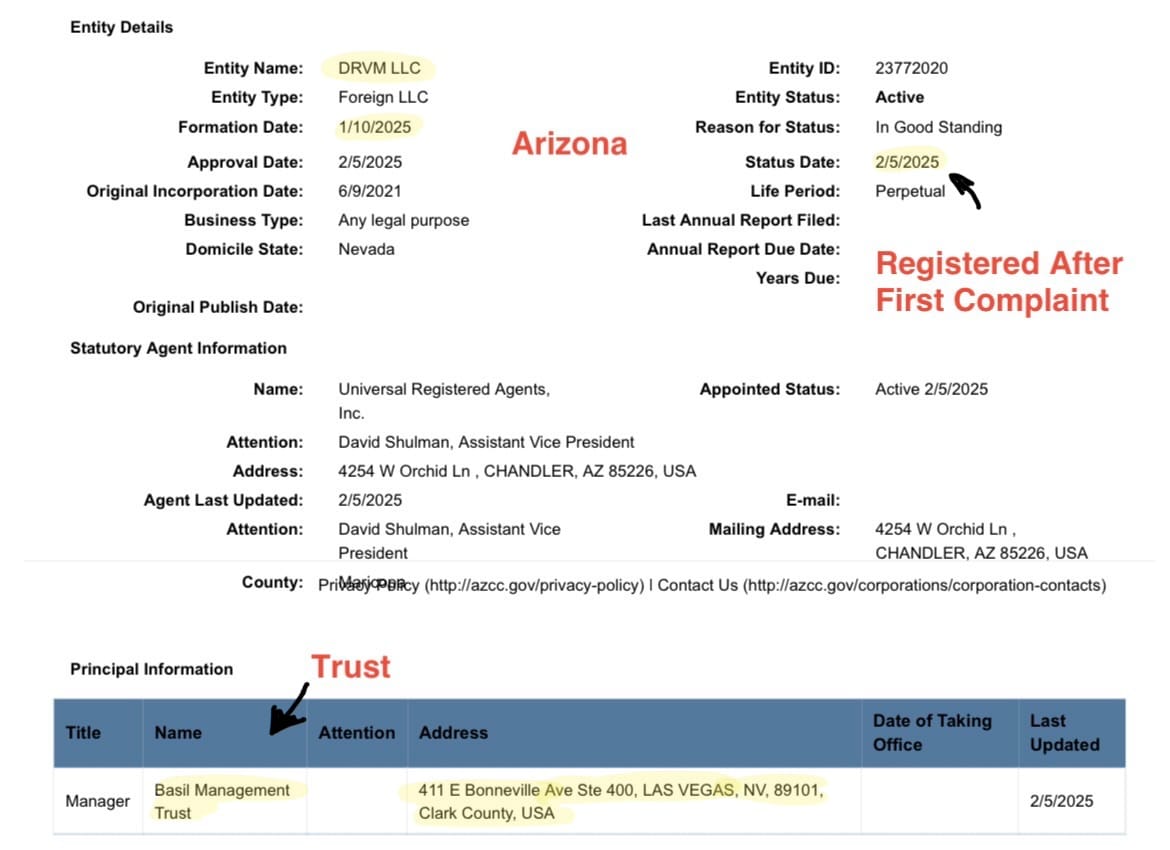

DRVM LLC—the company that issued my paychecks—was already dissolved. That’s a fact. I included the dissolved license in my exhibits. But what happened next proves everything:

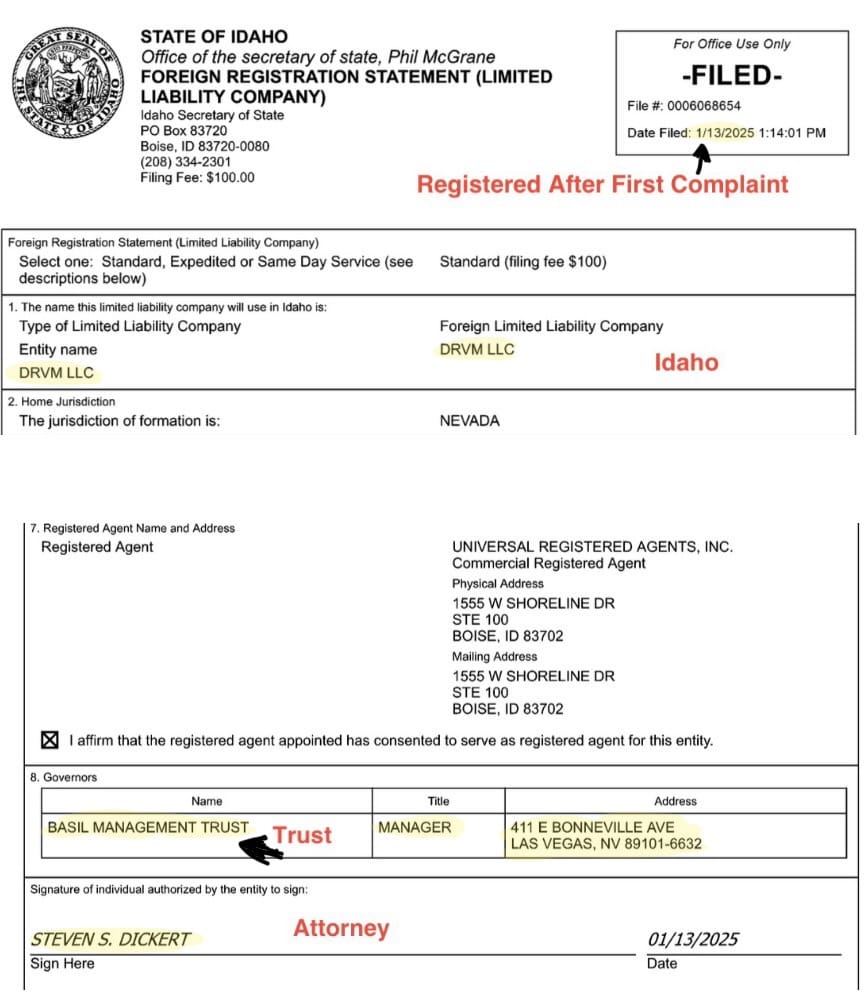

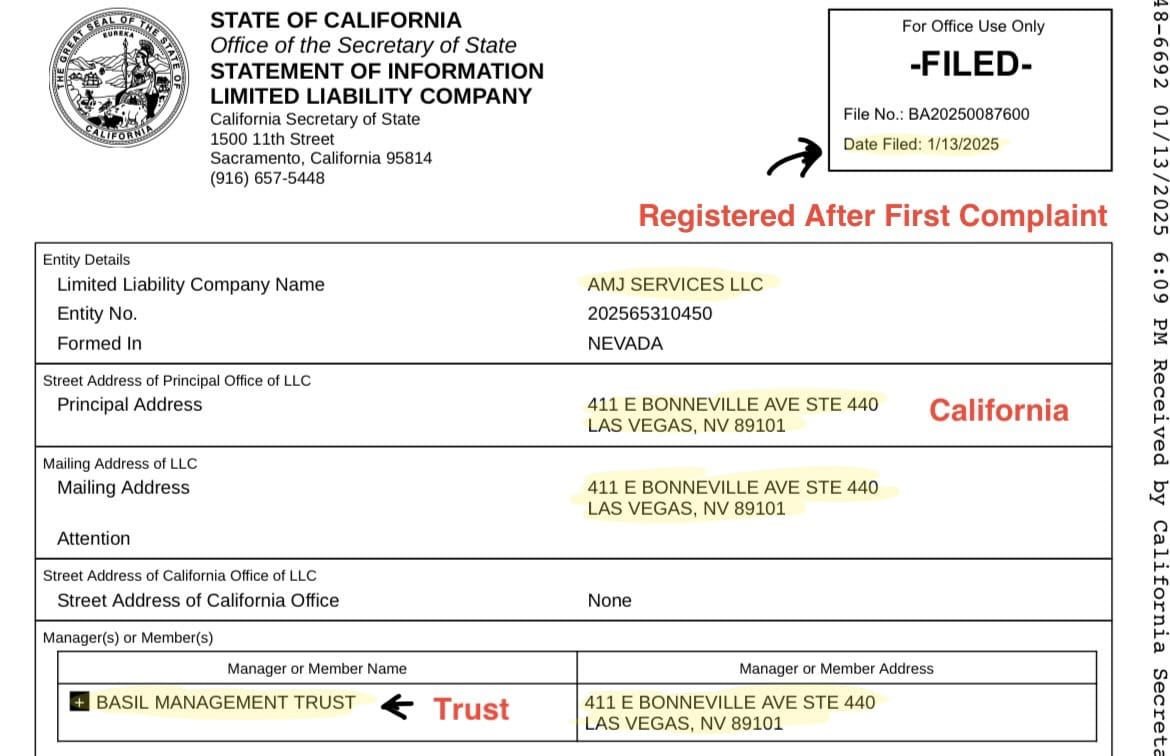

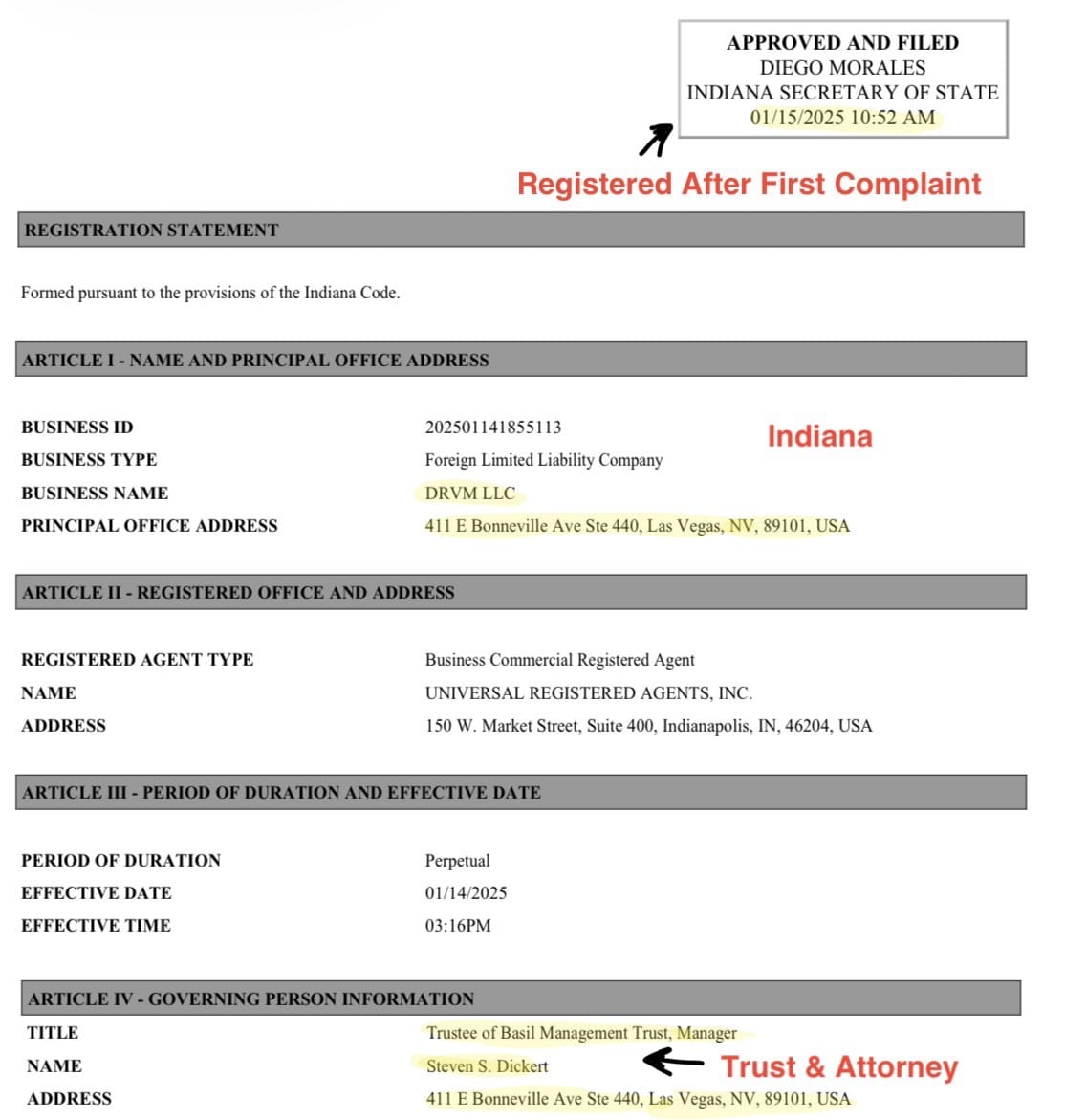

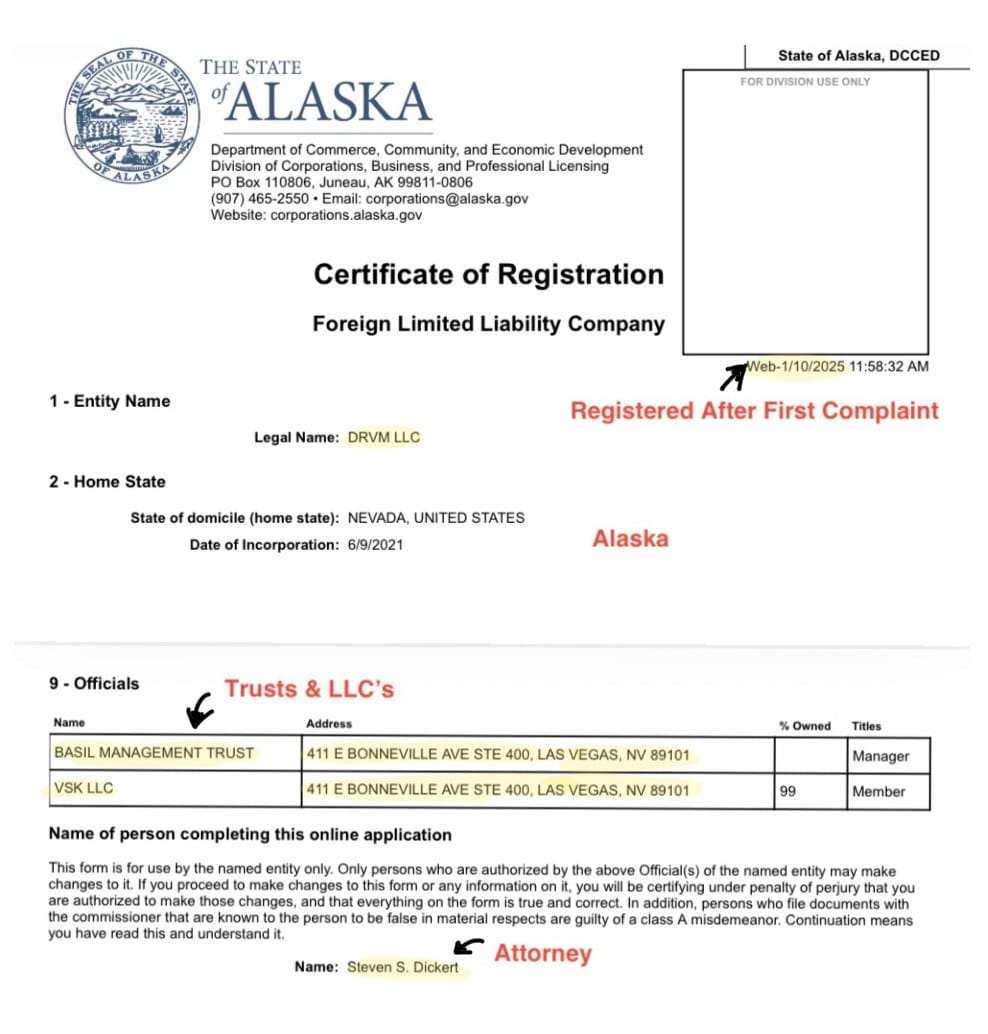

• Within days of my first complaint, DRVM or associated entities were reactivated under new or modified names.

• These activations occurred in multiple states.

• In some cases, the filings were made under trusts or new manager names, but still linked to the same Bonneville Ave address that appears on my paystub.

• The timing is impossible to ignore. These were not routine renewals. They were strategic moves after they were notified of exposure.

I will be listing screenshots of each state’s business registry showing these reactivations—timestamped, verifiable, and matching the address used to issue my paychecks.

The Secret Deposit That Should’ve Never Happened

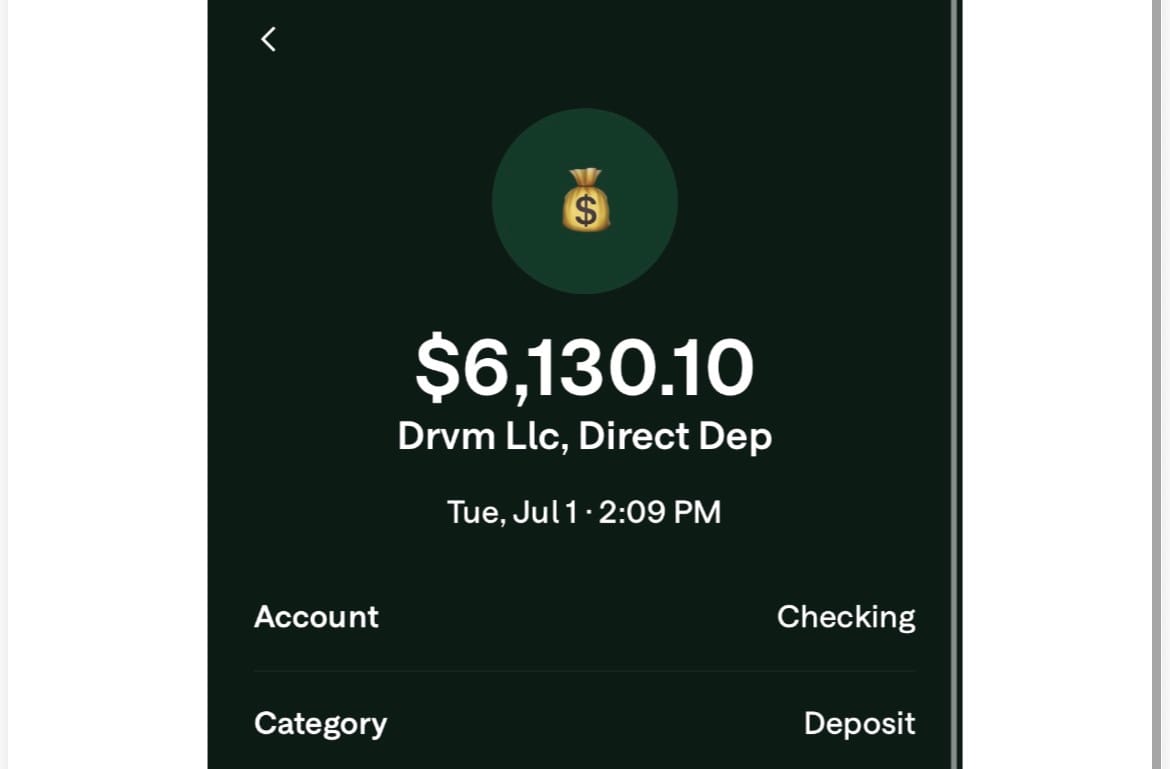

Seven months after I stopped working, and six months into arbitration, DRVM suddenly sent me a $6,130 deposit—without explanation, without public disclosure, and without notifying JAMS. I didn’t even know it had been deposited until I checked my account.

Why would they do this?

Because they knew they were exposed. The deposit wasn’t just hush money, it was a procedural move meant to try and moot the case. They wanted to make it look like they had paid what was owed, despite never acknowledging the fraud or even participating in arbitration properly. That money wasn’t payment. It was a tactical play.

Intent Is the Key, And It’s Already Here

Fraud can be hard to prove. But proving intent is even harder.

Yet this case doesn’t just prove the scheme, it proves the conscious decisions made in response to being caught.

• They reactivated a dissolved company right after being notified.

• They made a secret deposit to the claimant mid-arbitration, without documentation.

• They’ve used shell companies, trusts, and layered ownership across multiple states to hide their tracks, until now.

These aren’t coincidences. These are deliberate actions.

You Don’t Need to Believe Me. Just Read the Documents

This post isn’t about asking for belief. It’s about giving access.

I’m uploading every relevant exhibit, business license, and filing screenshot so the public can walk through the timeline themselves. You’ll be able to:

• Match the paystub to the business address

• See the reactivations across states

• Trace the manager names and shell overlaps

• Confirm the $6,130 deposit timeline

This case will be public because it has to be. And every piece of evidence is right here.