New Federal Fraud Lawsuit Filed: Hollingsworth v. Sanofi et al.

Filed December 11, 2025 — U.S. District Court, District of Oregon

Case No. 3:25-cv-2308-SB

On December 11, 2025, I filed a new federal lawsuit in the United States District Court for the District of Oregon against Sanofi-Aventis U.S. LLC, Chattem Inc., Quten Research Institute LLC, AMJ Services LLC, and Steven S. Dickert, in his capacity as Trustee of Basil Management Trust.

This case is not a wage dispute. It is a federal fraud and concealment action that arose only after a routine unpaid-wage issue exposed a much broader corporate structure operating behind the “Direct Demo” brand.

How This Case Began

The matter originated as a claim for approximately $637.15 in unpaid wages following my work as a W-2 product demonstrator inside Oregon Costco warehouses. When the entity listed on my paystubs—DRVM LLC—failed to pay, I reviewed public records to determine who was legally responsible.

That review showed that DRVM LLC was a revoked and unregistered shell entity during my entire period of employment. Further investigation revealed that DRVM was part of a larger, long-running network of Nevada-based entities sharing the same address, officers, trust ownership, and operational functions.

What the Investigation Revealed

The complaint alleges that a single, unified enterprise operated through layers of shell companies and trusts to conceal the identity of the true employer while directing a nationwide demonstrator workforce. According to public filings, payroll records, and corporate registrations:

• Multiple entities tied to the workforce shared the same Nevada address and officers.

• Employee-facing systems, training materials, and handbooks identified companies different from the entity listed on wage and tax documents.

• Payroll for different product lines was commingled and routed through defunct or inactive entities.

• After whistleblower disclosures and arbitration filings, the same shell entities were retroactively activated across multiple states, rather than being lawfully registered during the time employees were working.

The investigation further traced operational and financial control upstream to Sanofi-Aventis U.S., through its subsidiaries Chattem and Quten, following Sanofi’s 2023 acquisition of Quten Research Institute.

Multi-Forum Proceedings and Why This Case Is Separate

Before this filing, related issues were pending in:

• JAMS arbitration, limited solely to a narrow wage claim against DRVM LLC;

• A Department of Labor Taxpayer First Act retaliation proceeding, arising from federal whistleblower disclosures; and

• A prior petition to compel arbitration in federal court.

On November 24, 2025, the Court ruled that only DRVM LLC could be compelled to arbitrate—and only on the narrow wage issue—because the other entities were not signatories to the arbitration agreement. That ruling left all enterprise-level issues, including fraud, concealment, alter-ego liability, and civil conspiracy, outside arbitration and appropriate only for judicial review.

This new lawsuit addresses conduct that cannot be resolved in arbitration or administrative proceedings, including:

• Concealment of the true employer’s identity;

• Use of dissolved or unregistered entities to issue wage and tax documents;

• Coordinated corporate restructuring following whistleblower activity; and

• Contradictory representations made across arbitration, federal court, and the Department of Labor.

What This Case Seeks to Address

The complaint asserts claims for fraud, fraudulent concealment, civil conspiracy, alter-ego liability, and successor liability, and seeks to hold the upstream controllers of the enterprise accountable for conduct carried out through shell entities and trust-controlled companies.

This filing is intended to ensure that the full structure—rather than a single revoked shell, is evaluated by a federal court with jurisdiction to examine the complete factual record.

The filed complaint and exhibits are available for review and detail the corporate records, timelines, payroll evidence, and state-by-state filings underlying these allegations.

Filing of the Federal Fraud Complaint

After filing the federal fraud case in December, I submitted:

• The Complaint

• All supporting exhibits

• The full structural record tied to the enterprise allegations

At that point, no defense counsel had formally appeared for AMJ Services LLC or Steven S. Dickert (Trustee of Basil Management Trust).

However, I already knew Fisher Phillips had been involved in related proceedings since April 2025.

December 12 – Inquiry to Fisher Phillips

On December 12, the same day the federal lawsuit was filed, I emailed Fisher Phillips directly.

I asked a straightforward question:

Are you representing AMJ Services and the Trustee in this federal case?

They did not respond.

This is notable because:

• They had been involved in arbitration matters since April 2025.

• They were aware of structural and payroll issues already raised.

• They had previously been served preservation-related communications.

There was no reply.

Early January – Formal Service

In early January, I formally served AMJ Services and Steven S. Dickert As Trustee of Basil Management Trust.

Shortly thereafter, Fisher Phillips appeared.

They initiated a new email thread stating that they represented:

• AMJ Services LLC

• Basil Management Trust (through the Trustee, Steven Dickert)

They then requested an extension to February 6, stating they had been “recently retained” and needed time to review the Complaint.

The Extension Request

The request stated they were recently retained.

However, Fisher Phillips had been involved in related matters since April 2025.

Rather than responding to my December 12 inquiry, they waited until after formal service and then characterized themselves as newly retained in their extension request to the Court.

The request was filed late in the evening.

Because I did not yet have electronic filing access, I began preparing an opposition but was unable to reach the courthouse in time the following day.

The Court granted the extension.

Fisher Phillips’ new response deadline became February 6.

Appearance of Faegre Drinker

After Fisher Phillips secured their extension, a second major law firm entered the case.

Faegre Drinker Biddle & Reath LLP contacted me stating they now represented:

• Sanofi-Aventis U.S. LLC

• Chattem Inc.

• Quten Research Institute LLC

They requested a 30-day extension.

That would have pushed their response deadline to February 20 — two weeks after Fisher Phillips’ February 6 deadline.

The Staggered Deadline Issue

If granted as requested:

• Fisher Phillips’ deadline: February 6

• Faegre Drinker’s deadline: February 20

This would have created staggered briefing and staggered motion practice.

From a procedural standpoint, staggered deadlines can:

• Multiply briefing cycles

• Increase procedural complexity

• Force overlapping responses

• Expand litigation burden

I responded with a counterproposal:

Instead of 30 days, I proposed 21 days.

That would align their deadline at February 11, reducing the staggered effect.

Faegre Drinker agreed.

They filed their extension request with the Court reflecting a February 11 deadline.

Procedural Posture at That Point

At that stage:

• Fisher Phillips had a February 6 deadline.

• Faegre Drinker had a February 11 deadline.

• Both major defense firms had formally appeared.

• Multiple defendants were now represented by large national law firms.

This marked the point where the upstream parent entities formally entered the litigation, and coordinated defense counsel began shaping the response strategy.

February 5 – Meet and Confer with Fisher Phillips

On February 5, I participated in a required meet-and-confer call with Fisher Phillips regarding their anticipated Motion to Dismiss.

These calls are intended to be conducted in good faith under Local Rule 7-1 — to clarify positions and determine whether any issues can be narrowed before motion practice.

This call was not routine.

Their Stated Position

During the call, counsel outlined the core structure of their defense:

• They intend to challenge standing.

• They intend to challenge fraud under Rule 9(b).

• They intend to argue alter ego and successor liability are not standalone claims.

• They intend to assert that any injury must be resolved exclusively through arbitration.

• They intend to challenge personal jurisdiction and structural allegations.

In short: they signaled a full Rule 12 attack — what is commonly referred to as “throwing the kitchen sink” at the complaint.

Tone and Conduct of the Call

Throughout the call, counsel repeatedly emphasized that I am not an attorney.

Statements were made along the lines of:

“I know you’re not an attorney, so I can explain this to you.”

They repeatedly suggested I was misunderstanding the law and misreading corporate structure.

I was also asked multiple times whether I would consider voluntarily withdrawing the case.

Meet-and-confer calls are supposed to be conducted in good faith to clarify legal positions. Instead, the tone of the call was adversarial and condescending.

There were multiple moments where counsel attempted to speak down to me or control the framing of the discussion.

I remained professional and focused on substance.

Structural Disputes Raised on the Call

One of the core issues discussed was ownership and control.

Counsel asserted that:

• Steven Dickert is not the “owner.”

• He serves as Trustee.

• The entities are separate.

• Corporate formalities are maintained.

At the same time, their own declarations acknowledge:

• He is CFO of DRVM and AMJ.

• He is Trustee of Basil Management Trust.

• The Trust holds a controlling interest in DRVM.

• AMJ provides payroll and HR services.

Those structural admissions are now part of the federal record.

The call made clear what their strategy would be:

Emphasize formal separateness.

Minimize enterprise coordination.

Narrow the case back to wage arbitration.

Challenge fraud pleading standards.

Attack standing.

Strategic Takeaway

What became clear during the call is that the defense intends to:

• Aggressively challenge the complaint at the pleading stage.

• Frame the case as a simple wage dispute.

• Avoid structural examination beyond DRVM.

• Seek dismissal before discovery.

The February 5 call was not about resolution.

It was about positioning.

And it confirmed exactly how the defense plans to approach this case moving forward.

On February 6, 2026

Fisher Phillips, one of the largest employment defense firms in the country, has filed a Motion to Dismiss on behalf of AMJ Services LLC and Steven S. Dickert (Trustee of Basil Management Trust).

In the motion, they argue:

• I lack standing.

• Only DRVM was my employer.

• Any injury must be resolved exclusively in arbitration with DRVM.

• The fraud-based claims fail under Rule 9(b).

• Civil conspiracy, alter ego, and successor liability are not properly pleaded.

• Alternatively, the entire case should be struck.

However, in the same filing, they also ask the Court to compel arbitration against AMJ and Dickert as third-party beneficiaries of the DRVM arbitration agreement.

That dual position is significant:

• For dismissal, they argue separateness.

• For arbitration enforcement, they argue interconnectedness.

The motion is supported by sworn declarations from the CFO/Trustee and from counsel. Those declarations confirm overlapping leadership roles, trust control, payroll servicing, and entity structure — all now part of the federal court record.

The Court must now decide whether:

• The case proceeds beyond DRVM,

• The structural fraud and concealment claims survive,

• AMJ and Dickert can enforce the arbitration agreement,

• Or the case is narrowed back to wage-only arbitration.

This filing formally locks in the defense’s structural position under oath — and moves the dispute from theory into sworn federal record.

Federal Court Update

A formal Notice of Fraud on the Court has now been filed in the federal case (3:25-cv-2308-SB).

The notice addresses the submission of an altered arbitration agreement and sworn testimony that materially misstates the effect of a prior court order, both filed in support of the defendants’ Motion to Dismiss and Motion to Compel Arbitration.

Because the arbitration agreement is central to the defense strategy, and because all federal filings are certified under penalty of perjury, the discrepancies had to be formally preserved on the record.

The Court will determine the significance of the issues raised.

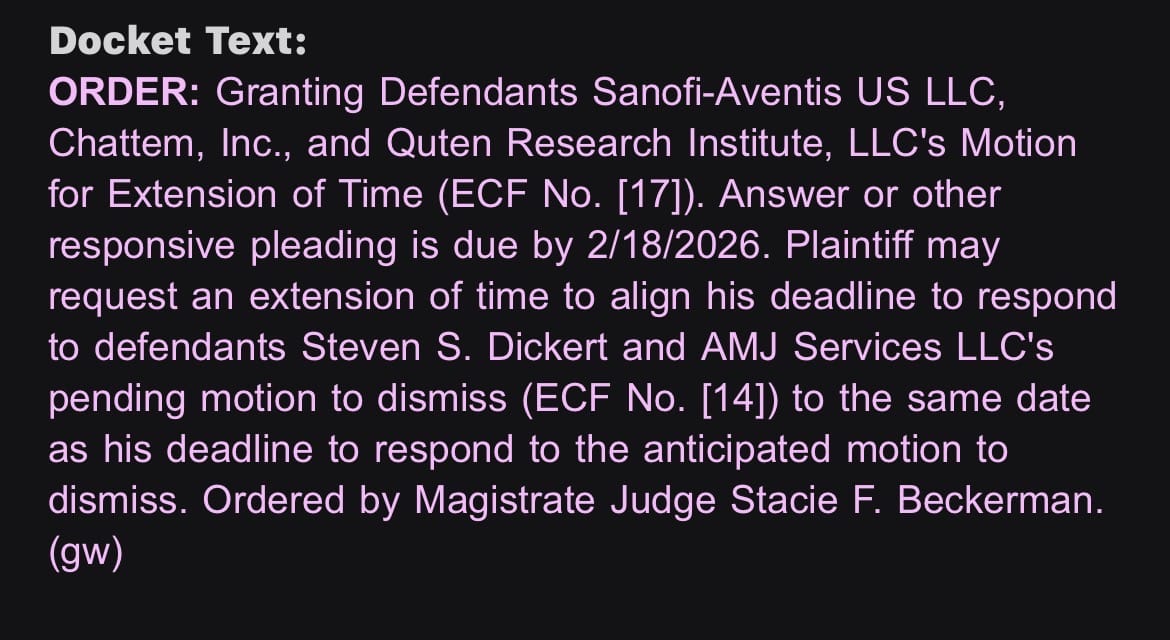

Federal Court Update: Extension Granted — Deadlines Aligned

Here is what ultimately happened with the second extension request filed by Faegre Drinker (Sanofi, Chattem, Quten).

Recap

• The parties had agreed to a February 11 deadline specifically to avoid staggered briefing.

• On February 9, during our meet-and-confer call, Faegre Drinker previewed their entire anticipated Motion to Dismiss in detail.

• At the end of that call, they requested an additional seven-day extension.

• I explained I did not oppose reasonable extensions — I opposed staggered deadlines.

• I proposed aligning opposition deadlines to avoid inefficiency.

• They declined.

They then filed their Second Motion for Extension, supported by declaration.

I filed an Opposition explaining the prior agreement and the risk of staggered briefing.

They filed a Reply.

They also emailed chambers requesting expedited ruling.

The Court’s Ruling

Right before 5:00 PM on February 11, the Court granted the extension.

However — and this is important, the Court also permitted me to move to align my opposition deadline to match the new Sanofi deadline.

In other words:

The extension was granted.

But the Court addressed the staggered-deadline issue.

The very alignment solution I proposed — which defense counsel declined — is now effectively in place through the Court’s management of the schedule.

What This Means

This was never about denying seven days.

It was about:

• Avoiding staggered briefing cycles.

• Avoiding overlapping opposition deadlines.

• Preventing unnecessary procedural complexity.

• Ensuring fair and efficient case management.

Had defense counsel agreed during our February 9 call to align opposition timing, this entire motion practice likely could have been avoided.

Instead:

• A motion was filed.

• An opposition was filed.

• A reply was filed.

• Chambers were contacted.

• Judicial resources were expended.

And the end result is what I proposed at the outset: aligned deadlines.

Where Things Stand Now

• Faegre Drinker has additional time to file their Motion to Dismiss.

• My opposition deadlines can now be aligned.

• The staggered briefing issue has been addressed.

The Court preserved efficiency.

And thankfully, the schedule is now structured in a way that avoids the procedural imbalance I raised from the beginning.

More updates to follow.