Legal Filings

This page documents the full legal record of the $15 billion corporate fraud arbitration legal case initiated by Jorden Hollingsworth. It includes the original demand letter, procedural filings with JAMS, and all submitted documents from both respondents and petitioner. Every motion, response, and exhibit is preserved for public review — from the first filing against DRVM LLC to the ongoing clash with billion-dollar law firms like GRSM and Fisher Phillips.

This page is updated in real time, ensuring full transparency in one of the most significant AI-assisted legal battles in history.

The demand was sent to Maged ”Mike” Boutros ‘s email address, work email address, physical work address, and DRVM‘s email address. Within a few days, I received an email and physical mail from Gordon Rees Scully Mansukhani (GRSM), informing me that they are now the representative for DRVM LLC and to proceed all contact through them.

There was no response to my demand so I continued to submit the case to JAMS, which is the arbitration forum that we both agreed to use for this kind of case. I originally submitted a regular demand through the portal. Then, submitted a 64 page amendment with over 100 exhibits which is the core arbitration demand.

After filing the core amendment, I had to make sure that I served 8-10 respondents the entire filing. DRVM LLC, AMJ Services, Maged “Mike“ Boutros, Quten Research Institute LLC (Qunol), Chattem Inc (IcyHot, Allegra), Sanofi-Aventis US (Owner of Chattem and Quten), Ashraf “Peter” Boutros & Deepak Chopra (Co-founders of Quten), and Marie-Laurie Amiard-Boutros. The entire structure is named. That will where they try and get you. If anyone dodges or you can’t track them down, they can use that to get themselves dismissed. A loophole to one of the biggest fraud structures of our time.…

Service was finally done on almost all of them. Getting that loophole closed. So, GRSM started playing another game. Decline representation on the original respondents before the amendment which named the entire structure. If you look back to my first ever legal demand to DRVM, I succeeded service to the supposed CEO of this company. DRM was legally dissolved in the state that I was in. Usually LLCs prevent the CEO from being sued. A loophole to one of the biggest fraud structures of our time.…

AMJ Services was another name I saw on some of the emails with the supposed HR to “Direct Demo,” I knew something was there. So to get to ball rolling quickly with arbitration, I quickly named the front structure. In the legal world, if another company that continues the same business practices is opening right after the closure of the previous business, and you owe money on that specific company, your new company is the successor company. They are liable for any fines or lawsuits.

So, I named the dissolved DRVM. Dissolved as in which means I am able to sue the CEO, pierce the corporate veil. So, Maged “Mike” Boutros and the successor company, AMJ Services LLC, is named in the original demand. So, GRSM was representing the entire first structure at this point. For an entire month without clarifying any representation issue. The official demand literally was addressed to directly Maged “Mike” Boutros.

As soon as I realized the outer layer of the fraudulent structure, and who all was included. I amended my filings and named everyone. GRSM wanted to pull back and have me attempt service on the original CEO and successor company, AMJ Services, while now having to service all of the new parties. Okay. Let’s go.

When the “Hands Off” movement was happening, I saw the same pattern in my case, unchecked power, hidden systems, and no accountability. I thought the timing was perfect. If this case went public then, people would see exactly what it was.

So I gave them the chance to settle. Multiple chances.

I sent a full settlement letter, originally valuing the case at $10 billion, and routed it through their law firm (GRSM). This was literally on April 7th, 2025, near the “Hands-off.”

No response. I amended the valuation to $15 billion, warning that if they kept playing legal games instead of acting in good faith, it would all become public.

While investigating this case, I reviewed the largest corporate frauds in history. The structure and scale of this scheme involving dissolved entities, hidden payroll, and a global pharmaceutical company, is on par with them. That’s why the valuation was set at $10 billion, and later increased to $15 billion based on continued concealment and legal misconduct.

I thought going public would change everything overnight. I believed the truth alone would be enough. I was wrong.

This sparked a major turning point early in the case. No resolution. Just collision. On the date GRSM decided to confirm receipt of the Fourth Amendment Demand and a follow up, they provided a notice stating they are determining whether they will even represent any party other than DRVM LLC and asked for an additional 2 weeks to determine.

What happens that day is unprecedented… A powerhouse law firm, Fisher Phillips, submitted A Notice of Appearance on DRVM LLC. Hmmmm….. So, two major law firms representing the same dissolved company. The company that has no legal standing because in the eyes of the law, it doesn’t exist.

Okay. I am expecting to be up against multiple law firms in this case. The lawsuit has eight (8) parties. Even JAMS expect this. So, when Fisher Phillips submitted their Appearance. The question was simple. JAMS simply stated “Please advise whether your firm is taking over for GRSM or acting Co-Counsel.”

“ I am unaware of GSRM being involved here. I am assuming they are acting on behalf of one of the others named.” <——-

Wow. A partner at one of the most prestigious law firms in the United States. I have seen the other side of court rooms and even I know you never say “I assume.” Especially when what you assuming is completely wrong. They were right. The other law firm is acting on behalf of one of the others named. Unfortunately for them, they are saying they represent the same shell company as you are appearing for it. So, what this tells me is that there are parties behind the scenes that are making decisions without officially appearing. All eight are definitely behind the scenes. Just all of them are hiding behind one dissolved shell company. That’s malpractice... Fraud on the tribune… Obstruction of the legal process..

JAMS stated multiple times that multiple law firms are saying they are representing the same party without each other knowing. Please confirm who is representing who. Three different times. There has never been a response…

Another legal loophole on one of the biggest fraud cases in our time.. So, I kept pushing..

Now, let’s talk about what happened throughout that time in the email thread. There was quite a few events that transpired during that time That truly have a huge impact on this case. What this case is systematic on a global scale..

On April 8th, 2025, in Exhibit B - Settlement Letter. I mentioned that if no resolution is made in this case, I will proceed with the valuation amendment, as well as filing whistleblower complaints to the SEC, DOL, OIG, & IRS. As the arbitration agreement states, “Employee retains the right to pursue claims before any government enforcement agency.” Just following every line in the arbitration agreement.

On April 25th, 2025, DRVM LLC - the dissolved company at the center of the case - suddenly reactivated its Oregon business license in the middle of arbitration. The entire dispute revolves around the fact that they operated while dissolved, so reactivating now raises serious legal concerns. It points directly to intent, which is what prosecutors look for first. Reactivating after being called out suggest an attempt to cover tracks and obstruct evidence, a major turning point in the case.

Just three days later, on April 28, 2025, I received formal notice from the IRS Whistleblower Office confirming that three separate numbers were assigned to Sanofi, Chattem Inc, and Quten Research Institution. These are not handed out lightly. I am not allowed to comment further, but the IRS instantly acknowledging the claim speak volumes.

Another event happened that day on April 28th, 2025. After pushing on for clarification on who is representing which respondent, as well as the collision between GSRM and Fisher Phillips, GRSM officially withdrew without clarification. Without replacement. That kind of withdrawal usually does not happen. That brings up a lot of questions...

Then on May 14th, 2025, Sanofi announced a $20 billion US investment in jobs and the R&D. This is a company currently named in a $15 billion arbitration case. The timing of this PR move, just after whistleblower confirmation and an entity reactivation, raises clear questions.

——————————————————————————————————————————

Throughout the moment of the law firm collision to the commencement of the JAMS case, there was complete silence from the other side. Through service, through JAMS notices sent to all eight respondents physical address, there was complete silence from everyone. Every respondent is letting the front shell company, DRVM LLC, take charge in the $15B fraud legal case.

Silence, another legal loophole. All of the follow-ups and administrative procedures, Fisher Phillips & the parties were just watching. Had to push at every level because of the silence. For months, just hiding while they are trying to obstruct the entire legal process. (This doesn’t happen to millions of people. We get more charges for waiting or being transparent.) Below is the email thread of the attempts to keep integrity of the entire legal process.

Getting to commencement of the case was more challenging than it needs to be. I thought it would be challenging since there are eight parties named in the arbitration and coordinating all of that. Nope. It was challenging because they were hiding the entire time, and still continue to hide.

When the official Notice of Intent was sent out, the official invoices were sent out with it. Waiver Fees in this kind of case are so hard to get granted. In the official arbitration agreement, it mentions, “ employee must pay arbitration filing fees up to the amount the employee would have to pay to file a lawsuit in court.” I have been court literally hundreds of times due to how the system is. I know something valuable to the people who have been abused by this legal system.

You have to pay all your money to the courts or to your attorneys. If you are poor, they assign a court-appointed attorney to play with your life. If you are the one pursuing the lawsuit and you are the poor one, good luck. They made it a law where you are able to represent yourself, even though the entire legal system laughs at you representing yourself.

They will literally bury the case instead of watching you win. But, they have to let you represent yourself. So, if you are ever poor and representing yourself, there is a thing called a “waiver.” Usually, they will grant this if you can prove it. The clause in the arbitration agreement in short said ”as the court would.” So, I gave the Fee Waiver a try. Official filed and officially got it granted.

Now, the filing fee has to be fully paid by Fisher Phillips. All I did was follow what they made me sign. Once the official invoice goes out, a good rule of thumb is around 10 days to pay it. That did not do so. They would have 30 days before I am able to actually file in federal court. So, I pushed on day 10. There is a rule in JAMS arbitration - Rule 6(e) - where if one of the sides is obstructing the legal process, they can assign the arbitrator (the one who oversees the entire case - what we know as a judge) without any input on who gets chosen. So, on day 10, I tried to invoke rule 6(e), with my input of the arbitrator since I have been the only party keeping the legal case going.

In response, JAMS officially notified all parties that they will issue a final invoice and they will dismiss the case after 30 days of noncompliance. Immediately, Fisher Phillips reported the payment has been made that morning. A day after the obstruction rule was submitted, as well as my nomination of arbitrator.

Please see the AI page to know the full background on this. AI is a core part to building this case. At least for myself. Used for corporate law research, business research, legal strategy, case law, legal drafts. I know the other side is using the best AI models in the world while I’m just using the public model. It was used in place of the entire unlimited resources that the $120B pharmaceutical company has, and the entire legal resources for the most prestigious law firms in the country.

This case is highly technical, complex, and the first documented case of AI being used in favor of a major prestigious law firm by one person. I am one of the most transparent person and I’ll prove that throughout this process. So, let’s have a person who co-authored the actual JAMS Arbitration AI Rules. I want the one who actually wrote the rules so I don’t personally misstep any of the AI rules and it is fully understood how much AI plays a core piece in this entire case. To understand that this is one of the most AI and tech emerging cases in history.

They absolutely do not want this. They want someone who doesn’t see the future of AI. They want someone more procedural and by the book. Not a futuristic thinker. Even though Sanofi is a self proclaimed AI leading pharmaceutical company in the world. Deepak Chopra has his own AI version of himself. The most elite law firms have the most advanced AI legal tools. Even JAMS, the arbitration forum, is the leading technology breakthrough ADR, forum to handle legal disputes.

But when a “Pro Se“ wants to use it instead to playing their traditional legal game, it is an issue and they will put their foot down on it. In their mind, AI wasn’t made for me. It was made for them. Everyone talks about the future, but wants to rely on system from 250 years ago, while they just can dodge the legal system using money, influence, & power. (Because the legal system was actually made for them) So, they officially objected to the nomination of Dr. Ryan Abbott. I figured that completely. I knew they were going to do so. The reason, “ this case does not turn on matters algorithmic design, AI ethics, or emerging technology.” And,

“ uncomplicated Oregon wage dispute.”

A partner of a prestigious law firm, just called this case an uncomplicated state wage dispute. So what about the multiple withdrawals? All of the silence? Why no clarification? Has they even read the demand that mentions this is a multi state fraudulent payroll scheme? Another legal loophole... Minimize one of the most biggest cases in the world right now and try and get it dismissed into a wage dispute regarding one small claim. That is all the legal system is. Legal loopholes on how to get the cases dismissed on technicalities. Not truth… Okay, just have to keep on pushing…

Filed in official response to Fisher Phillips about their objection of the AI background arbitrator. JAMS officially notified all parties that the arbitration agreement that was signed says, “ if parties cannot agree on an arbitrator, the court can assign one.” To notify them when we have agreed or if we have agreed to the strike and rank arbitrator list. Or, to notify them when the court has assigned one.

Finally. Legal grounds to petition a federal court to assign the arbitrator that has the most experience to handle this type of case. The most experienced needs to be on this case that has the best understanding of everything in this case. Another benefit, the biggest one.. It instantly goes public. All of the months that have gone by and the games to keep everything silent. Even arbitration to keep everything buried. Gone. No more trying to get a hold of reporters and trying to convince them. No more getting banned from websites. A spotlight. Global knowledge…

So, I gave them a 48 hour deadline - July 1st, 2025 - to agree on AI arbitrator strike and rank list. That the list has to have an AI & emerging tech background and truly have experience for this type of case. They would have to admit that this is the first ever AI documented case in history and now somebody with experience needs to oversee the case. After that 48 hour period, I will submit to the federal court a Petition to Assign An Arbitrator. Instant spotlight on the case.

I did not expect what came next…..

A few hours after I submitted the Notice of 48 Hour Deadline Email, I received $6,130.10 from DRVM LLC to a bank account I haven’t used in over 6 months. July 1st, 2025. What?…. Completely shocked.. Who sent it? Who signed off on it? Why didn’t it go through legal? What was the actual amount since there is no paystub, no conversation, no court order, no settlement agreement? It was meant to destroy the entire case.. To have it not be noticed or brought up, and they can get the case dismissed on a technicality saying the original wages have been paid. No case. No reason to continue. Really? Right when I was about to submit to the federal court? Another legal loophole to get out of the biggest fraud case in our history.

I officially made it Exhibit 110 in the legal case. I’m not using that. Just because we need money doesn’t mean we will take anything and just go away quietly. Now this is going to be a major turning point in the case. There are a lot more questions now that they tried to derail the entire legal process. Truly, who signed off on it? The next day after the 48 hour deadline, Fisher Phillips agreed to the AI and emerging tech qualified arbitrator Strike and Rank List, with their little condition on it. They also have to have experience in ”Oregon Wage & Law.” That is a given. The rule is that you always apply the state law the work appeared in.

Here is what they are doing. They are trying to agree to the type of case this is to not go federal, but that’s not the words they used. They just will say “Okay, we agree but it is still a small claim.” Again, did they even read the actual 66-page demand of the entire case? This has to do with all 50 states. So, yes this huge structure first cracked open in one little state. But that’s not what this case is about. It’s about the nationwide fraud structure. Which now, you would go by state and federal laws.

Now, at the moment, we are waiting for JAMS to submit the arbitrator list that Fisher Phillips and I will rank and strike based on our preferences. So the moment is here, will JAMS provide a list of arbitrators that are experienced for this type of case, now that we’ve already set the precedent that this one of the first documented cases needing AI and emerging tech experience.

On July 16, Fisher Phillips submitted their official Answer to the arbitration demand. The document denied nearly every allegation in full, including the existence of any unlawful wage practices, disputed the employment relationship itself, and failed to acknowledge the recent $6,130.10 post-termination payment. This omission is glaring, especially given that the payment was made just hours after I enforced a 48-hour deadline for arbitrator selection under JAMS Rule 15(b), and mere days before I was set to file the federal petition. No explanation. No paystub. No agreement. Just silence.

Even more concerning, the Answer was filed solely on behalf of DRVM LLC, a company that was dissolved during key events in this case. Under ORS 63.654, a dissolved Oregon LLC cannot legally maintain proceedings until reinstated. Fisher Phillips filed its Notice of Appearance during the period in which DRVM was legally dissolved. If DRVM had no standing, then who authorized the Answer? Who made the $6,130 payment? These inconsistencies only deepen the concern that unnamed parties are controlling litigation strategy from behind the scenes, without ever appearing on record.

Fisher Phillips also failed to CC the case manager, on the delivery of their Answer—a small but telling procedural deviation. While they did upload it to the JAMS dashboard, they chose to email me directly instead of following the usual protocol. That kind of sidestep matters in a case where every move is calculated.

In response, I issued a follow-up email on July 16 to JAMS and all parties, pointing out the inconsistencies in their Answer, reaffirming the impact of the $6,130.10 deposit, and noting that any further delay or deviation in arbitrator assignment would force me to explore all available procedural remedies. I have waited in good faith for months, and I’ve been transparent every step of the way. They have not.

As of now, we are still waiting for JAMS to issue the strike-and-rank arbitrator list. The moment this list fails to reflect our agreed criteria, or if any more stalling occurs, I will immediately proceed with the federal petition. There are no more excuses left. This case is about corporate deception, procedural manipulation, and a legal system that bends to wealth and power, unless someone refuses to let it.

On July 22, JAMS has confirmed to my follow up that they are now preparing the official strike-and-rank arbitrator list, which is expected to be sent within the next week. I made it explicitly clear that every arbitrator on that list must have documented experience with AI and emerging technologies. That agreement, already acknowledged on the record, makes this the first documented AI-assisted arbitration in legal history. Now the world gets to see who they try to put forward. The moment that list fails to meet the criteria, or if there is any additional delay, I will move forward with the federal petition. This is no longer just about what they’ve done. It’s about whether we let them keep doing it.

The Strike List Was Built to Work Against Me — Even After I Cooperated

On July 25th, 2025, After months of delay tactics from the respondents. I complied with the process. I gave the system one last chance to act fairly. In return, JAMS issued a strike list so mismatched, it borders on deliberate obstruction.

This is not a routine wage dispute or contract claim. This is one of the largest documented healthcare fraud cases in U.S. history, involving:

• Over $15 billion in alleged fraud

• W-2 employees paid under dissolved or non-existent companies

• A complex shell structure used to evade payroll and taxes

• Multiple entities now under federal IRS whistleblower filings

• The first known AI-assisted litigation against a global pharmaceutical company

• And a multinational player at the center: Sanofi-Aventis

Despite all this, not one arbitrator on the JAMS strike list has experience with:

• Healthcare fraud or pharmaceutical compliance

• Federal whistleblower law

• AI in legal proceedings

• Modern shell structuring or dissolved-entity concealment

Instead, I was handed a list of retired judges and attorneys who are undeniably qualified in their respective fields — including wage disputes, employment law, family law, personal injury, probate, landlord-tenant issues, and construction defect cases.

But not one has ever ruled on a case involving billion-dollar pharmaceutical fraud.

Not one has overseen an AI-assisted legal strategy.

Not one has dealt with entity-layered concealment of W-2 employees across dissolved corporations.

Here is the wild part — JAMS has experts in AI, forensics, cyber law, and healthcare fraud. They even co-wrote their own AI arbitration rules. They just didn’t include them. And you really think that’s random?

This isn’t neutrality. It’s misalignment by design.

After the IRS confirmed claim numbers. After I exposed the shell layers. After I built the case with precision and made it public for accountability, this is the list they give me? No one even remotely equipped to evaluate the facts?

That’s not coincidence. It’s engineering.

The Strike List That Broke the Deal

Let’s be clear, the only reason this case wasn’t already in federal court was because both sides agreed: the arbitrator list must include individuals with a proven background in AI and emerging technology. That agreement was made on record. Fisher Phillips agreed. I agreed. And JAMS confirmed it.

But when the list came? Not a single arbitrator on it had AI or emerging tech qualifications. Not one had experience overseeing whistleblower-driven cases, shell structuring, or fraud at the level we’re dealing with. This was not just oversight, this was a betrayal of the framework that kept this case in arbitration. I gave so much respect to jams throughout this past six months as a forum. I brought them a $15 billion pharmaceutical fraud case that could shape their image as a ADR. (Another way to file your legal claims other than public court). And they gave all the power to the ones that are obstructing this entire case for months.

So I immediately set a hard line: JAMS has 48 hours to fix the list. Not seven days, not procedural delays — 48 hours. Because this is not a normal dispute. This is a documented, AI-assisted, $15B fraud case implicating global pharmaceutical power and the misuse of arbitration to silence it.

Later that day, JAMS responded, trying to invoke a routine seven-day procedural window, a move designed to give Fisher Phillips time to object under typical rules. But these aren’t typical circumstances. These arbitrators aren’t qualified, and the entire premise of staying in arbitration was built around the understanding that only properly qualified arbitrators would be considered.

I made it simple: If the respondents agree to Ryan Abbott or Daniel Garrie — the two men who co-authored the JAMS AI Arbitration Rules — I will not petition the federal court. If not, the 48-hour clock stands, and I will file. Full stop.

Instead of acting, they asked Fisher Phillips if they agree. They already agreed to the criteria. The list didn’t meet it. That’s the issue. Now they’re buying time.

The deadline passed. Still nothing.

So I followed through — on July 31, 2025, I filed the official federal petition under 9 U.S.C. § 5. A formal motion to compel the appointment of an arbitrator qualified in AI-assisted litigation, whistleblower law, wage fraud, and emerging technology.

I made it public. I named everything. The shell companies, the IRS claim confirmations, the deposit, the law firm collision, the obstruction, and the tech gap. I uploaded the exhibits. I gave the judge every document — emails, filings, withdrawals, official notices — all in one place. No secrets. Just the truth.

Hollingsworth v. Sanofi-Aventis US et al - 3:25-cv-01342-AB

The petition was assigned to Judge Amy Baggio of the U.S. District Court for the District of Oregon — a former federal public defender and Multnomah County judge, with a career history of fighting systemic injustice. I don’t know how she’ll rule yet, but I trust that she knows how deep this goes.

And just like that — it’s public. Fully. Unstoppably.

The $15B arbitration case is now in the hands of a federal judge, with whistleblower documentation, AI precedents, and a trail of procedural misconduct all preserved on record. What started as an ignored demand letter is now positioned to expose a global fraud network that’s evaded governments, journalists, and watchdogs for years.

The world will now know the fight that has been going on behind closed doors for the past 6 months. And see the real time suppression of a federal whistleblower against a global pharmaceutical company.

And I’m still here. Every step documented. Every move public.

Respondents Just Filed — And It Says Everything About Power

August 14, 2025 — Federal Case Update

Before the court even granted or denied my IFP (in forma pauperis) waiver…

Before formal service of the petition was completed…

Respondents filed their response. And it’s a 9-page attempt to discredit, deflect, and distort what this case is about.

Let me walk you through what just happened — because this isn’t just about procedure. This is about truth, power, and what happens when a federal whistleblower forces a billion-dollar entity into the light.

Filing Before IFP or Service? That’s Not Normal.

In most civil lawsuits or federal petitions, the process is clear:

• First, the petitioner files.

• Then, the court decides whether to waive filing fees under IFP.

• Only once that’s done, and formal service is completed, do respondents reply.

But here, before any of that happened, the respondents jumped the line. That tells you one thing:

They want to influence the judge before the case even properly begins.

They’re trying to poison the well early — to paint me as unserious, unqualified, and somehow abusing the process… all while I’m simply asking for a qualified arbitrator in one of the most complex whistleblower cases in modern history.

They Say I’m “Not a Whistleblower”

Let that sink in.

Despite:

• Confirmed IRS whistleblower filings (with assigned claim numbers),

• A formal DOL/OSHA retaliation complaint, and

• Thousands of pages of exhibits showing systemic payroll concealment and fraud…

They told the court I’m “trying to recast this as a whistleblower case.”

It is a whistleblower case.

But this is what power does. It denies reality. It tries to strip you of your legal identity — to erase your status, your protections, your credibility — just so they can control the narrative.

They Agreed to AI & Tech Qualifications — Now They Say It Doesn’t Apply?

In prior communications, the parties agreed to choose an arbitrator with experience in artificial intelligence, emerging technology, and Oregon wage law.

Now suddenly, they’re saying that doesn’t apply here. That it’s not relevant. That the arbitrators I proposed — including the co-authors of JAMS’ own AI rules — aren’t appropriate.

Then who is?

They say: a “retired judge.”

Everyone in legal circles knows what that means: procedure over truth. Delay over disclosure. Power over people.

The Filing Is Full of Attacks

They didn’t just disagree. They attacked me. Aggressively.

• They accuse me of creating a “media spectacle.”

• They say I’m “trying to make this case about something it’s not.”

• They imply I’m stirring up trouble, chasing attention, and abusing the court’s time.

Meanwhile, they:

• Secretly paid JAMS over $7,000 off the record,

• Hid behind shell companies

• And now object to the very arbitrators they originally agreed to.

So let’s be honest: this is gaslighting in legal form.

Ask yourself:

• Why file before the case even starts?

• Why pretend I’m not a whistleblower?

• Why try to bury this behind a retired judge?

This is why I’ve gone public.

Because what they’re doing behind closed doors needs to be seen in daylight.

And that’s what this site is for.

To document the truth, no matter how hard they try to silence it.

Notice of Retaliation & Whistleblower Status — August 14, 2025

One day after I submitted a formal whistleblower retaliation complaint to the U.S. Department of Labor under the Taxpayer First Act, Fisher Phillips—counsel for Respondent DRVM—filed an aggressive response in federal court.

This was before:

• The court granted or denied my fee waiver (IFP)

• Formal service had been completed

• The case had officially begun

Their response was meant to discredit me, not to address the facts. It tried to paint me as irrational and conspiratorial—while ignoring the real issue: I’ve uncovered payroll fraud tied to a dissolved shell company used by Sanofi and related entities, and now two federal agencies (the IRS and OSHA) are reviewing my claims.

Why I Filed the Notice

I submitted a formal Notice of Whistleblower Filings and Retaliation to inform the judge:

• I’m a protected federal whistleblower

• Retaliation has escalated since my IRS claims

• The tactics they’re using—social media suppression, shell reactivation, secret payments, and forum manipulation—are now well documented

This is no longer just about arbitration. It’s about whether the federal court will allow those same tactics to continue—or take the first step toward fairness by assigning a qualified arbitrator, as the law requires.

Notice of False Claims — August 18, 2025

After Respondent DRVM LLC filed a response falsely claiming that “several parties were removed from arbitration by JAMS,” I submitted a Supplemental Notice of Record Clarification to correct the record before the court makes any decisions.

Here’s what really happened:

• JAMS never removed any parties.

• GRSM, their law firm, simply withdrew representation for AMJ Services and Maged Boutros — no dismissal occurred.

• I re-served the parties in good faith. JAMS never issued a ruling to remove them.

They also claimed the parties were “unrelated.” But even JAMS’ own documents show AMJ Services and DRVM are the same entity — and Maged Boutros is the CEO of DRVM, the dissolved company that employed me.

This notice wasn’t a reply — it was a factual correction to protect the court from being misled. No arguments. Just truth, backed by exhibits.

They’ve used shell companies, vanished records, and misstatements to stall this case. I filed this notice to ensure fairness and prevent more abuUntil now, the case was stuck in arbitration, shielded from public view. Respondents hid behind one dissolved shell company while pretending the rest were unrelated.

But after they filed a misleading federal response — downplaying the fraud, lying about JAMS, and trying to discredit me — the judge still moved the case forward.

Now, the case is public. All parties are on notice. And they can’t hide behind arbitration anymore.

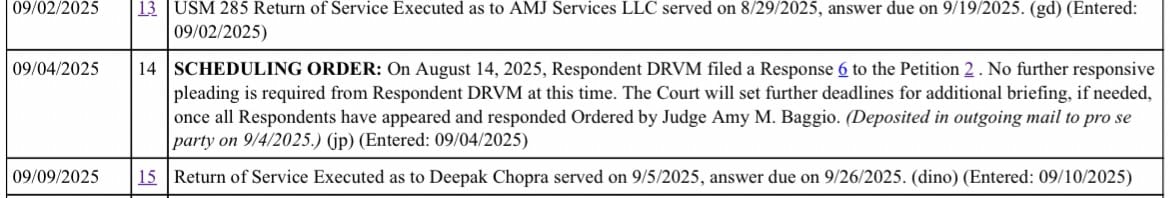

Judge Approves Service on All Parties & Grants IFP - August 18, 2025y

The court just gave me permission to serve every respondent named in my petition not just DRVM, but Sanofi, Chattem, Quten Research Institute, AMJ Services, and Maged Boutros.

This marks a turning point.

Until now, the case was stuck in arbitration, shielded from public view. Respondents hid behind one dissolved shell company while pretending the rest were unrelated.

But after they filed a misleading federal response — downplaying the fraud, lying about JAMS, and trying to discredit me — the judge still moved the case forward.

Now, the case is public. All parties are on notice. And they can’t hide behind arbitration anymore.

Motion to Deem Service Effective — September 17, 2025

After Sanofi and Chattem refused to accept U.S. Marshal service at their Tennessee headquarters, I filed a Motion to Deem Service Effective or, in the alternative, to Authorize Alternative Service. This motion explains:

• Service was properly attempted under Rule 4 by the Marshals.

• Both companies were already actively participating in arbitration at that same address.

• Federal law allows service on corporate agents and officers, not just registered agents.

The point was simple: billion-dollar companies shouldn’t get to duck behind technicalities after receiving notice at their own headquarters. The Court now has to decide whether rules apply evenly, or whether wealth allows an escape hatch.

Even though the judge specifically told DRVM not to file again until all respondents show up, they filed one for ALL respondents to have them not show up.

Miller Nash Enters for “Deepak Chopra” — September 17, 2025

On the very same day, the prestigious firm Miller Nash appeared on behalf of “Deepak Chopra.” Their expected move is a Motion to Dismiss, claiming I named the wrong party. Even if they file that, it comes as other respondents have already blown their deadlines. Some entities — like AMJ Services and Maged Boutros — have simply failed to respond. Instead of answering as required, we now see DRVM and its lawyers trying to shield everyone from accountability through one procedural motion.

DRVM’s Motion to “Correct” the Docket — September 19, 2025

On the exact day their deadline hit, DRVM — through Fisher Phillips, filed a motion asking the Court to “correct the docket for all respondents.” In reality, it was a request to erase deadlines and defaults so that one shell LLC could speak for nine separate companies. Here’s what they tried to do:

• Reset every deadline as if no one had missed.

• Pretend Sanofi, Chattem, and others had no responsibility to respond.

• Use DRVM as a shield for corporations they claimed were “unrelated.”

If granted, it would wipe away months of delay, defaults, and missed obligations. If denied, it proves the very obstruction I’ve been documenting.

Petitioner’s Opposition to DRVM’s Motion to Correct Docket - September 22nd, 2025

After DRVM and Fisher Phillips attempted to have the Court “correct” the docket for all nine respondents, I filed an Opposition explaining why that move was not just improper, it exposed the deeper pattern I’ve been documenting since this case began.

This motion wasn’t about a simple clerical fix. It was about control, evasion, and accountability. DRVM, which has repeatedly claimed to be “unrelated” to the other entities, tried to step in and speak for every respondent, including Sanofi, Chattem, Quten, AMJ Services, and the Boutros family, after being explicitly told by the Court that no further pleading was required from them. The filing was an attempt to erase deadlines, rewrite the record, and blur the lines between companies that claim independence but move as one.

My Opposition makes clear that:

• Each respondent must answer for itself. DRVM cannot erase default deadlines or file on behalf of companies it claims not to represent.

• The Court’s orders matter. Allowing one entity to rewrite them would undermine the entire federal process.

• The structure is now undeniable. The same law firm entering appearances for “unrelated” companies is the very proof of coordination I’ve been warning about.

This filing also emphasizes that the Federal Arbitration Act (FAA) was designed for speed and integrity, not delay and manipulation. By using a dissolved LLC as a shield for billion-dollar corporations, respondents are not correcting a docket — they’re confirming a nationwide obstruction.

Dr. Chopra’s Motion to Dismiss - September 22nd, 2025

On the same day, Deepak Chopra filed his motion. After using a required meet and confer under Local Rule 7-1(a), Dr. Deepak Chopra, represented by Miller Nash LLP, filed the first Motion to Dismiss in this case. The motion asks the Court to dismiss all claims against him under Rules 12(b)(2), (5), and (6) claiming lack of jurisdiction, improper service, and failure to state a claim.

At first glance, it looks procedural. But in reality, this was the moment Chopra officially entered the record while trying to erase himself from it. He swore under oath that he has never owned, managed, or communicated with any of the entities named, not Sanofi, Chattem, Quten Research Institute, the shells, or any individual involved. He even went so far as to say he has never met or heard of any of them, and that the first time he supposedly learned about any of this was when arbitration papers were left with a receptionist at the Chopra Foundation.

But the problem with that statement is time. Chopra already acknowledged learning about the case back in March 2025, meaning he stayed silent for over six months while his name appeared across corporate filings, trust registrations, and public exhibits tied to a multi-billion-dollar fraud structure now under federal review and already logged with the IRS. With SEVERAL notices from the arbitration forum all throughout those 6 months.

So the question becomes: if he truly had no connection, why stay silent for half a year while his name was being used on active business registrations, arbitration documents, and payroll structures tied to ongoing investigations? Why wait until September, only after multiple motions, agency submissions, and court filings, to claim ignorance?

The motion itself cherry-picks from the arbitration, isolating one paragraph to argue that Chopra was simply “mentioned” without involvement, while ignoring all of the attached evidence showing his name and signature across the same companies now under scrutiny. It’s a selective-memory strategy, an attempt to rewrite the timeline and redefine what he already knew.

For readers following the case, this motion is the setup. In his Reply, Chopra directly reverses parts of his own declaration, contradicting the very claims he made here about having no knowledge, no ties to Oregon, and no connection to the parties. This entire motion was about him. Defending himself. Protecting himself. Which is exactly what Motion To Dismiss is supposed to be.

Petitioner’s Opposition to Dr. Chopra’s Motion to Dismiss - October 1st, 2025

After weeks of silence and misdirection, I filed my Opposition to Dr. Chopra’s Motion to Dismiss, grounding this case back in facts, filings, and evidence, not celebrity reputation or legal spin.

Chopra’s Motion to Dismiss claimed he had no ties to Oregon, no involvement with any respondent, and no idea who any of these companies or people even were. My Opposition dismantled that story line by line, showing that his name is all over the corporate structure, across state filings, trust registrations, and shared business addresses already confirmed in my IRS whistleblower exhibits.

The Opposition laid out what the documents show: Chopra is listed as organizer and manager of Rita GP Partners LLC, an entity named after his wife, Rita Chopra, directly tied to the 411 E. Bonneville Avenue address, the same address printed on my DRVM paystub. Those filings, attached as exhibits in my Opposition, are the same ones the IRS currently holds in their investigation. They show his name appearing repeatedly throughout the same network of companies and trusts that connect back to Sanofi-Aventis U.S., Chattem Inc., Quten Research Institute, and the Boutros family.

I explained that this case is not about a mistaken identity, it’s about a nationwide payroll fraud structure that runs through dissolved shell companies, reactivated LLCs, and interlocking trusts designed to conceal the real beneficiaries. Chopra’s name and signature appear in multiple states: Oregon, Nevada, Florida, and Utah. These filings aren’t coincidences, they’re part of a coordinated network operating under one control hub.

I also addressed the timeline. Chopra’s name had been in the arbitration caption since March 2025, and JAMS sent repeated notices to his own Chopra Foundation address, the same one the U.S. Marshals later used in federal court. For six months, he said nothing. That silence wasn’t harmless, it was strategic. It allowed entities to move under new trusts while pretending nothing was connected. If someone truly had no involvement and saw their name attached to an IRS-level fraud case, they would immediately clarify or disavow it. Chopra didn’t.

My Opposition also exposed how he cherry-picked a single line from the arbitration record, the phrase “payroll specialist” to build his defense, while simultaneously telling the Court that none of the arbitration record should be considered. That’s not law, that’s manipulation. You can’t selectively quote from a record while claiming the rest of it doesn’t exist.

Finally, I argued that the contradictions between his denials and the public filings make this a textbook case for jurisdictional and identity discovery. Under Ninth Circuit precedent, dismissal is premature when corporate control and identity are disputed. The record already contains his name, his signature, and his wife’s named shell company, all tied to the same Bonneville network.

Chopra’s Reply and the Contradictions - October 1st, 2025

Just one week after filing his Motion to Dismiss, Dr. Deepak Chopra, through Miller Nash LLP, filed his Reply in Support of Dismissal. This was the moment when denial turned into direct attack, when his tone shifted from defending himself to protecting the system being exposed.

In his first motion, Chopra was protecting himself. In this reply, he was protecting the case itself, the structure, the concealment, and the billion-dollar network now under investigation. He stopped arguing as an individual and started arguing as if the entire structure depended on his credibility.

Instead of addressing the evidence, Chopra’s reply attacked the person exposing it. His attorneys labeled my filings “nonsensical word salad” and a “grand conspiracy,” claiming I had “no idea who the correct Deepak Chopra actually is.” They dismissed hundreds of state-verified corporate filings, trust registrations, and IRS-linked exhibits as if they were fabricated, even calling them “unauthentic.”

But here’s the reality: the exact same filings are in the hands of the Internal Revenue Service, assigned to active whistleblower claims that have already been referred for audit. The IRS does not assign claim numbers and open audit reviews based on “unauthentic” documents. These are official state records bearing Chopra’s name, his wife’s company, and the same business addresses printed on my own paystub.

If verified state filings and trust records, the same evidence being used by a federal agency, cannot be recognized in federal court, then that is clear, undeniable grounds for discovery. You cannot dismiss official government documents as “unauthentic” simply because they prove what powerful people want to deny.

Chopra twists everything. In his original motion, he swore that he had no ties to Oregon, no business connections, and no relationship with any of the entities named. Then in this reply, he admits he is the founder and chairman of the Chopra Foundation, the same organization tied to the address used for six months of filings, notices, and federal disclosures. He shifts focus to a technical argument about service, pretending this case is about procedure instead of accountability.

The truth is simple: for half a year, every notice and filing went to an address he personally controls. When you represent yourself, you rely on the U.S. Marshals to serve. That’s not on the petitioner, it’s on the system. Due process overrides technical errors, especially when someone with multiple notifications chooses to remain silent.

But this reply exposes something far deeper than a procedural fight. Chopra isn’t defending himself anymore, he’s protecting the fraud. He’s defending the concealment and the silence of billion-dollar corporations already named in IRS filings. Even if he dislikes being named, his name is being used in a multi-billion-dollar fraud case that’s already under active federal review.

So the question becomes:

If you are truly about wellness, truth, and consciousness, why would you attack the whistleblower exposing it?

Why would someone who built a career on integrity and healing go to federal court to mock the person uncovering corruption tied to his own name?

His reply doesn’t answer those questions, it avoids them. It shifts the spotlight from the evidence to the whistleblower, using mockery and legal maneuvering to distract from what the filings actually show. But those filings are real, they are verified, and they are already in federal hands. The contradictions are now public and they speak louder than any attack ever could.

Jorden’s Motion for Leave to File Sur-Reply & Petitioner’s Sur-Reply - October 6th, 2025

It’s uncommon for courts to allow a Sur-Reply, an additional filing that comes after a reply. In most cases, the motion, opposition, and reply close the argument. A sur-reply is only permitted when the opposing party raises new arguments or evidence that could unfairly prejudice the other side’s right to respond. In this case, that’s exactly what happened.

Dr. Chopra’s Reply didn’t simply defend himself, it changed the entire scope of the case. His Motion to Dismiss focused narrowly on personal detachment, claiming he had no connection to Oregon or any of the respondents. But his Reply pivoted completely, adopting the same language and strategy as DRVM, calling the case a “fishing expedition,” “nonsensical word salad,” and “just a wage claim.” None of that was in his first motion.

By doing so, Chopra moved from defending himself to protecting the structure, using almost identical wording as DRVM’s earlier filings that dismissed the petition as “scattershot,” “legally baseless,” and “conspiracy-style.” His Reply also ignored the whistleblower notice that documents how this evidence triggered an IRS audit referral of Sanofi, Chattem, and Quten under the Taxpayer First Act. Instead, he dismissed the same state-verified filings, now held by the IRS, as “unauthentic.”

That’s why the Sur-Reply was critical. It explained that if verified corporate filings and trust documents, the same evidence already in federal agency hands, can’t be recognized in federal court, that alone is grounds for discovery. Chopra’s Reply attempted to erase the audit, deny the pharmaceutical connections, and reduce a nationwide fraud structure into a simple “wage dispute.” It was a calculated rewrite of the case narrative designed to protect those higher up.

In the Sur-Reply, I demonstrated that his filing met the exact legal standard for allowing a response:

• It introduced new arguments not raised in the Motion to Dismiss.

• It relied on omissions and distortion, excluding whistleblower evidence already acknowledged by the IRS.

• It used the same phrases and legal framing as DRVM, revealing a coordinated strategy meant to suppress the same facts from every angle.

This Sur-Reply was not about repeating arguments, it was about correcting the record and protecting truth from manipulation. Chopra’s filings no longer resembled a defense; they became a coordinated front to downplay and discredit a federal whistleblower case tied to one of the largest pharmaceutical companies in the world.

And that’s what makes this moment so important. Dr. Deepak Chopra is not an unknown name, he’s a global figure with millions of followers who look to him for guidance on wellness, integrity, and higher consciousness. Yet here he is, using his platform and resources to attack the one person exposing a nationwide pharmaceutical fraud connected to Sanofi, a corporation repeatedly linked to corruption, bribery, and unethical practices across the globe.

Instead of distancing himself from a structure using his name, his first instinct was to bash the whistleblower who uncovered it. A man known for preaching mindfulness and morality, now defending a corporate web built on deception. That single act speaks volumes about what this case has revealed: when truth threatens power, even the voices that preach light will turn to protect the darkness funding them.

The case has now reached a critical stage. The federal judge approved service on all nine respondents, confirming what I said from the start, that every one of them had been hiding behind the same shell company throughout arbitration. I warned the court about obstruction months ago, and now it’s playing out in real time on the docket.

Five respondents are past default, two of the top corporate parties are actively avoiding service, and another is twisting the judge’s own orders to delay accountability. Meanwhile, the most well-known respondent, the public figure with millions of followers, has stepped in to speak for all the others, arguing that this isn’t even a pharmaceutical case and portraying the whistleblower as “delusional.” It’s attack after attack, denial after denial, while the paper trail tells a completely different story. The obstruction that once hid behind closed arbitration doors is now happening in public, on a federal docket for everyone to see.